😓 Feeling buried under credit card bills, medical expenses, or student loans?

You’re not alone millions of Americans struggle to find a way out of debt.

That’s where DebtMD steps in a platform designed to connect you with the right debt relief solutions for your unique financial situation.

But is it actually legit? And can it truly help you become debt-free faster?

Let’s break it down in this honest, in-depth DebtMD Review (2025) no sugarcoating, just facts and real value.

🧭 What Is DebtMD?

DebtMD is a free online referral and comparison platform that connects people struggling with debt to trusted financial service providers including credit-counseling agencies, debt-settlement firms, and consolidation lenders.

It was founded in 2017 and is based in Wayne, New Jersey (USA).

Think of it as a matchmaker for debt relief solutions it doesn’t negotiate your debt directly or lend money. Instead, it helps you compare and connect with licensed professionals who do.

Their goal is simple:

“We offer the best credit-counseling, debt-consolidation, and debt-settlement solutions so people can easily compare their options and choose the right one with confidence.” – DebtMD.com

⚙️ How DebtMD Works: Step by Step

DebtMD makes the process of finding the right debt-relief option simple and stress-free. You don’t need financial expertise to get started just a few minutes and honest answers.

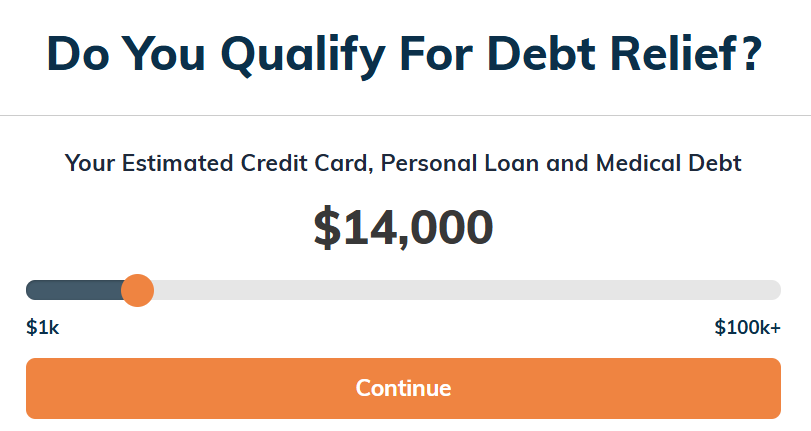

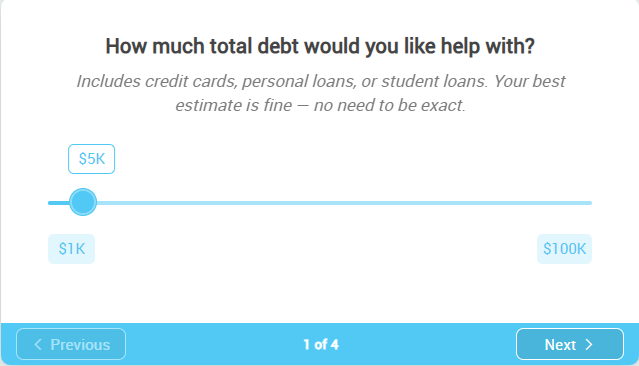

🪄 Step 1: Take the Smart Debt Analyzer Test

You begin by answering a short, confidential questionnaire on DebtMD.com.

Think of it as a quick “financial health checkup” you’ll share basic details such as:

- The types of debt you have (credit cards, student loans, medical bills, etc.)

- Your total outstanding balance

- Your monthly income and repayment struggles

This helps DebtMD’s system understand your debt-to-income ratio and identify which type of relief program fits you best.

💡 Step 2: Get Matched With Real Solutions

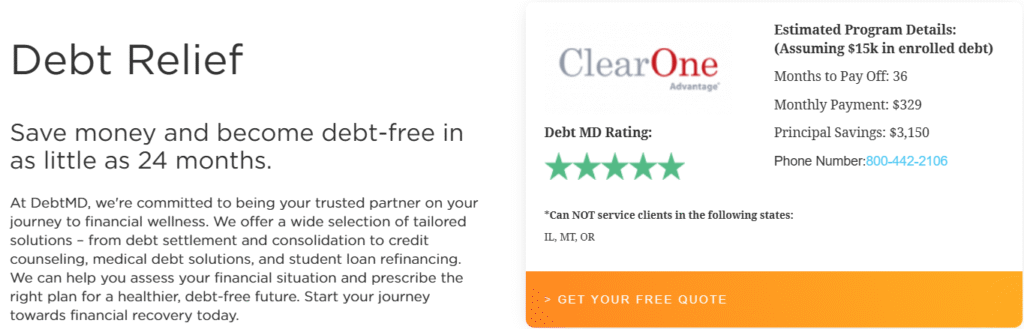

Once you complete the analyzer, you’re shown a personalized dashboard of potential relief programs and this is where the “Debt Relief” screen from the website comes in.

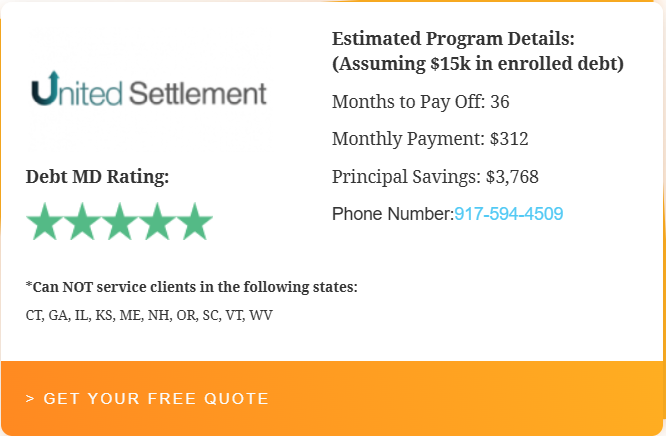

For example, on the Debt Relief page, you’ll see real partners such as United Settlement or JG Wentworth, each rated and reviewed by DebtMD.

Here’s what’s shown:

- ⭐ DebtMD Rating: Verified partner score

- 🕒 Months to Pay Off: Example – 36 to 48 months

- 💰 Estimated Monthly Payment: Example – $312 to $350

- 💵 Principal Savings: Example – up to $3,700–$9,000

Each listing also includes a “Get Your Free Quote” button that connects you directly to that partner’s consultation team.

💬 This is where the platform acts as a “matchmaker” — not selling services, but showing you your best-fit options.

🤝 Step 3: Speak to a Verified Specialist

After selecting a company, you can book a free consultation no strings attached.

A licensed professional from that provider explains your options in plain English how much you could save, how long it might take, and whether debt settlement or consolidation makes more sense.

It’s completely up to you whether to proceed or explore more options.

🚀 Step 4: Choose Your Plan and Start the Journey

If you find a plan that suits your goals, you move forward with the provider directly.

From that point, they handle the paperwork, negotiations, or refinancing — while DebtMD steps back.

The beauty of this model?

You get expert guidance before commitment, ensuring that your next move is informed, not impulsive.

🔒 Transparency First

DebtMD’s process is 100% free, secure, and educational.

They don’t share your data with random third parties, and you won’t get endless sales calls only the matched experts you choose to connect with.

Check If You Qualify for Debt Relief

🧩 Key Features of DebtMD

DebtMD isn’t just another debt-relief directory it’s a full-scale financial wellness platform designed to simplify tough money decisions.

Its features combine guidance, transparency, and smart technology so you can make confident choices without paying a single fee.

Let’s explore what makes it stand out 👇

💠 1. Debt Relief Programs

DebtMD connects you with professionals who can help you negotiate and settle your unsecured debts, often at a fraction of what you owe.

According to their website, users can become debt-free in as little as 24–36 months, depending on their situation.

You’ll see estimated examples like:

- 💵 Monthly Payment: Around $312

- ⏳ Months to Pay Off: 36

- 💰 Estimated Savings: $3,700 or more

These are sample projections meant to give you a sense of what’s possible before you talk to a certified expert.

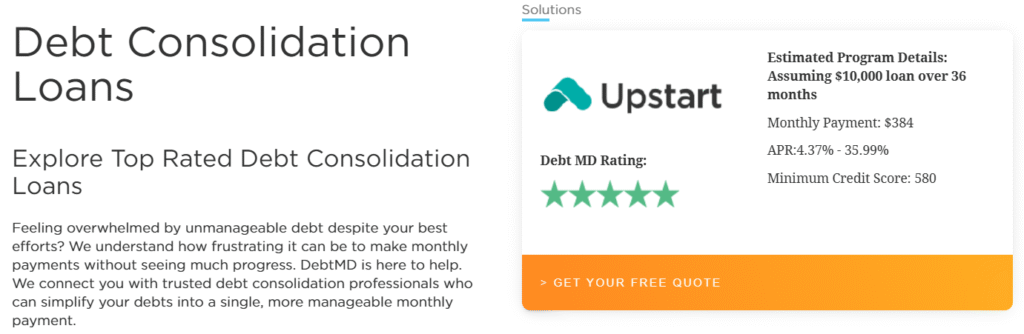

💳 2. Debt Consolidation Loans

If multiple high-interest debts are stressing you out, consolidation might be your best route.

DebtMD helps you connect with top-rated consolidation lenders who can roll all your payments into one simpler, lower-interest monthly bill.

This option works well if your credit score is decent and you’re looking to reduce interest rather than settle the debt.

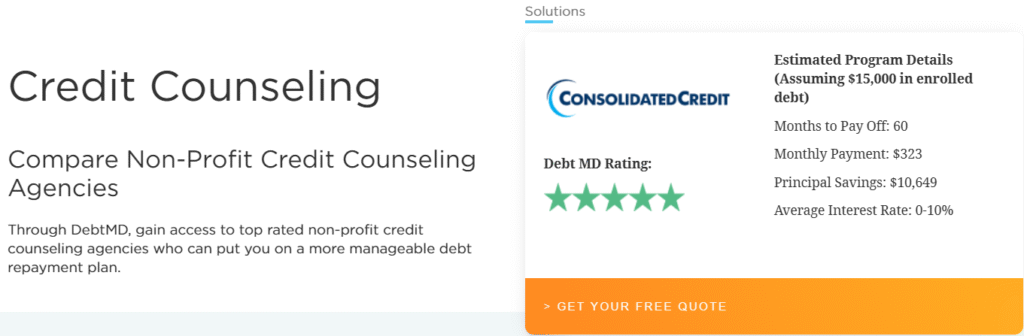

🧾 3. Credit Counseling

DebtMD also connects you with non-profit credit-counseling agencies that create structured repayment plans.

These agencies help you:

- Lower interest rates

- Avoid late fees

- Rebuild your credit over time

It’s a great choice for people who want to pay their debts responsibly with professional budgeting guidance.

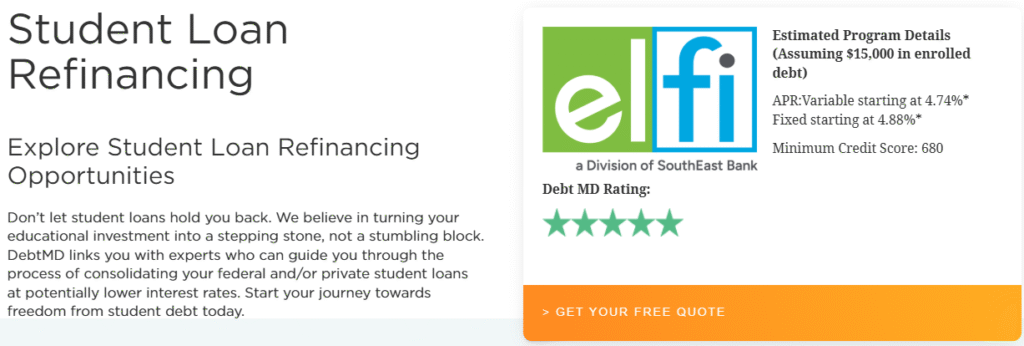

🎓 4. Student Loan Refinancing

Student loans can drag for decades, but refinancing through DebtMD’s partners can turn that around.

You can combine federal and/or private loans into one new loan at potentially lower interest rates, cutting years off repayment.

This is especially useful for graduates who want to save money without losing track of multiple accounts.

⚙️ 5. Smart Financial Tools

DebtMD offers free, easy-to-use calculators that make understanding your finances less intimidating:

| Tool | What It Helps You Do |

|---|---|

| Monthly Payment Calculator | Estimate what your consolidated or refinanced payment could look like. |

| Credit Score Calculator | See how your debt choices might impact your score over time. |

| Loan Payoff Calculator | Visualize how long it’ll take to become debt-free under different strategies. |

These tools are available to everyone no sign-up or email required.

🧠 6. Educational Resources

DebtMD’s blog and resource center cover real-life financial topics from rebuilding credit to handling medical bills.

The content isn’t pushy or sales-driven; it’s written to empower readers to understand the “why” behind their debt and take smarter actions next time.

💰 Cost & Fees – What You Actually Pay

One of the most refreshing parts about DebtMD is its complete transparency when it comes to cost.

There’s no fine print, no surprise subscriptions, and no “hidden service fees.”

Let’s break it down 👇

💸 DebtMD Is 100% Free to Use

You can explore every part of the platform from the Smart Debt Analyzer to the calculators and blog resources without spending a penny.

DebtMD earns its revenue from referral partnerships, not from users.

That means:

- There’s no charge to take the analyzer test.

- No consultation fee to speak with an expert.

- No upfront cost before you decide to move forward.

It’s completely risk-free to explore your options.

🧾 Partner Company Fees (If You Enroll)

While DebtMD itself is free, the partners you connect with will charge fees for the services they provide such as debt settlement or counseling.

These fees depend on the program type and your total debt amount.

For example:

- Debt-settlement companies often charge a percentage of the debt enrolled (usually around 15%–25% in the industry).

- Consolidation lenders may include interest rates or origination fees.

- Credit-counseling agencies might add a small monthly maintenance fee for managing your plan.

⚠️ DebtMD doesn’t control these rates it simply introduces you to verified professionals so you can compare them safely.

📞 Free Quotes Before You Commit

Each partner provides a free quote or consultation, so you can understand the cost and savings upfront.

You’re never locked in, and you can walk away at any point.

💡 This is where DebtMD stands apart you can compare several financial experts in one place without paying anything or damaging your credit score.

🧠 What DebtMD Does Best?

If there’s one thing DebtMD truly gets right, it’s simplicity with transparency.

Debt is already stressful confusing terms, hidden fees, and aggressive sales pitches only make it worse.

DebtMD does the opposite it guides you calmly through your options, with clarity at every step.

Here’s what it does better than most 👇

🌐 1. Brings All Debt Solutions Under One Roof

Instead of visiting multiple websites or applying to random lenders, you can explore debt relief, credit counseling, consolidation, and refinancing all in one place.

It’s like having a financial comparison tool made specifically for people in debt.

💬 2. Offers Real Numbers, Not Empty Promises

Every program listing shows estimated monthly payments, principal savings, and repayment timelines for example:

- 💵 Monthly Payment: $323

- ⏳ Months to Pay Off: 48–60 months

- 💰 Estimated Savings: $9,000–$10,000

While these are sample figures, they help users visualize their options before contacting a provider.

🧩 3. Matches You With Verified Partners

Each company in DebtMD’s network is vetted and rated many are national leaders in debt relief.

You’ll often see a “⭐ DebtMD Rating” on each solution page, showing that the partner has passed credibility and performance checks.

This ensures you connect only with licensed, trustworthy experts, not aggressive third-party brokers.

📚 4. Focuses on Education, Not Sales

DebtMD takes an educational approach.

Its blog and glossary explain terms like “debt settlement,” “consolidation loan,” and “credit counseling,” so you actually understand what you’re signing up for.

This builds long-term trust and helps you avoid mistakes that could hurt your credit again later.

🔒 5. Keeps Your Data Safe

DebtMD’s analyzer form is confidential and encrypted, meaning your financial details aren’t sold or shared with irrelevant companies.

Only the trusted partners you choose to connect with receive your information.

💡 Why You Might Need DebtMD’s Services

Debt can feel like quicksand the harder you try to climb out, the deeper you sink.

That’s exactly the situation DebtMD was created for: people who are doing their best but still can’t seem to make progress.

Here’s when using DebtMD can make a real difference 👇

💳 1. When You’re Juggling Multiple High-Interest Debts

If you’re managing several credit cards or personal loans with different due dates and interest rates, DebtMD can connect you with consolidation experts who combine them into one manageable monthly payment.

This can make your repayment plan easier and often reduce the total interest you pay over time.

🏥 2. When Medical or Emergency Expenses Took Over

Many Americans fall into debt not because of bad decisions but because of unexpected medical bills or emergencies.

DebtMD can help you explore medical debt solutions that allow you to negotiate or settle those balances more affordably.

🎓 3. When Student Loans Feel Never-Ending

If your student loans are dragging on and the interest keeps growing, DebtMD’s refinancing partners can help you find lower rates or combine multiple loans into one simplified plan.

This is especially valuable for graduates balancing several private and federal loans.

📉 4. When You Want to Protect Your Credit While Getting Help

Not everyone wants to go through aggressive debt settlement.

Through DebtMD, you can also find non-profit credit-counseling agencies that work to lower your interest rates while helping you repay what you owe without destroying your credit score.

🕰️ 5. When You Don’t Know Where to Start

Sometimes the hardest part of fixing debt is knowing your options.

DebtMD’s free analyzer and quote system give you clarity before commitment so you can compare strategies and costs before spending a single dollar.

💬 In short:

If your debts are piling up, your credit is dropping, or you just don’t know which direction to take DebtMD gives you a safe, structured, and stress-free way to start taking control again.

Check If You Qualify for Debt Relief

Pros and Cons of DebtMD

| ✅ Pros | ❌ Cons |

|---|---|

| Completely free to use – no hidden sign-up or consultation charges | Does not directly provide debt-relief services; only connects you to partners |

| Smart Debt Analyzer gives fast, customized solutions based on your financial data | Final results and savings depend on which partner company you choose |

| Access to verified partners for debt relief, credit counseling, and consolidation | Limited only to U.S. users; international users can’t access services |

| Transparent estimates like monthly payment, payoff time, and potential savings | Savings and timelines shown on site are examples, not guaranteed outcomes |

| Educational blog and calculators help users make informed financial decisions | Some partner programs might charge setup or service fees |

| User data is protected through encryption and shared only with selected experts | No direct customer service from DebtMD once you’re connected to a partner |

🔍 Is DebtMD Legit and Safe?

When it comes to financial services, trust is everything and DebtMD is one of the few platforms that keeps things transparent from start to finish.

Let’s break down its legitimacy and safety so you know exactly who you’re dealing with 👇

🏢 Registered & Established Platform

DebtMD was founded in 2017 and operates out of Wayne, New Jersey, USA.

It’s not a new or anonymous website it’s a known platform that has helped thousands of users find verified debt-relief professionals over the past few years.

🔒 Secure & Confidential

DebtMD uses secure data encryption for all online submissions.

Your details are only shared with the partners you choose, not sold to random third parties.

That means you won’t get bombarded with spam calls or emails from unrelated companies something that sets it apart from many “lead collection” sites.

🤝 Partnered With Licensed Providers

DebtMD’s network includes licensed and accredited U.S.-based companies that specialize in:

- Debt settlement

- Credit counseling

- Consolidation loans

- Student loan refinancing

Every provider you’re matched with is screened for legitimacy, ensuring you deal only with certified professionals.

⚠️ Important to Know

DebtMD itself is not a lender or debt-relief company.

It’s a referral platform meaning it helps you find verified professionals but does not directly handle your debt or negotiate settlements.

So your final experience may vary depending on which provider you choose to work with.

🔄 Alternatives to DebtMD

While DebtMD is an excellent starting point for exploring your debt-relief options, it’s always wise to compare a few other trusted names in the industry.

Here are some popular alternatives that you can look into alongside DebtMD 👇

| Platform | Type of Service | Key Strength | Ideal For |

|---|---|---|---|

| National Debt Relief | Debt Settlement | One of the largest and most recognized settlement companies in the U.S. with strong negotiation success. | Those with high unsecured debt (credit cards, personal loans, etc.) |

| Freedom Debt Relief | Debt Negotiation | Over 20 years of experience, offering customized debt settlement programs. | Users who want step-by-step guidance from enrollment to settlement. |

| Accredited Debt Relief | Debt Relief & Management | Known for tailored programs and strong customer support. | People needing flexible repayment and personalized plans. |

| Tally | Credit Card Consolidation App | Uses an automated system to pay off credit cards faster at lower interest rates. | Users with multiple high-interest credit cards. |

| Upstart | Personal Loan Provider | AI-powered loan approvals and competitive rates for consolidating debt. | Borrowers with fair credit seeking low-interest personal loans. |

💡 How DebtMD Differs:

Unlike these direct service providers, DebtMD doesn’t sell a specific program.

Instead, it helps you compare options across multiple debt types settlement, counseling, consolidation, or refinancing and connects you to the most suitable expert for your needs.

So if you’re not sure which path to take, start with DebtMD; once you know your best fit, you can compare providers more confidently.

Check If You Qualify for Debt Relief

⚖️ Final Verdict: Should You Use DebtMD?

DebtMD stands out as a transparent and genuinely helpful platform for anyone feeling trapped under growing debt.

It doesn’t overpromise, it doesn’t charge hidden fees, and it doesn’t push you toward one single solution.

Instead, it helps you understand your options, compare them, and make a smart financial decision all for free.

✅ Why It’s Worth Trying

- You get personalized guidance instead of generic advice.

- The process is completely free and confidential.

- It connects you with licensed, pre-screened debt experts, not random call centers.

- You can compare several approaches debt relief, consolidation, credit counseling, and refinancing without any pressure to sign up.

⚠️ Keep in Mind

- DebtMD doesn’t directly manage your debt; it connects you to providers who do.

- Fees and savings vary depending on which partner you choose and how much debt you have.

- Always review your chosen company’s terms, accreditation, and BBB profile before committing.

💬 Our Honest Take:

“DebtMD is not a quick fix it’s a clear starting point.

If you feel lost, confused, or skeptical about where to begin your debt-free journey, this platform gives you safe, informed direction without financial risk.”

❓ Frequently Asked Questions (FAQs)

1. Is DebtMD free to use?

Yes, DebtMD is completely free. You can explore all tools, get quotes, and connect with experts without paying anything upfront.

2. Is DebtMD a legitimate company?

Absolutely. DebtMD is a trusted U.S.-based referral platform founded in 2017. It securely connects users with licensed debt-relief professionals.

3. Will DebtMD affect my credit score?

No. Using DebtMD or requesting a free quote doesn’t impact your credit score in any way.

4. How long does it take to become debt-free?

Most users who join partner programs typically achieve debt freedom in 24–60 months, depending on the total debt and repayment plan.

5. What types of debt does DebtMD help with?

DebtMD assists with credit card debt, personal loans, medical bills, and student loans, connecting you to the best-suited relief or refinancing option.