Looking for a credit card that actually helps you build credit without complicated rules or sky-high deposits? 🚀

If yes, then you’re in the right place because today we’re breaking down how the Yendo Credit Card really works, who it’s designed for, and whether it’s worth your time. 💳✨

Before you apply for anything, you should know exactly what you’re getting into the good, the bad, and the hidden details most reviews never talk about.

Let’s walk through it step by step so you can make the smartest decision for your credit journey. 🙌

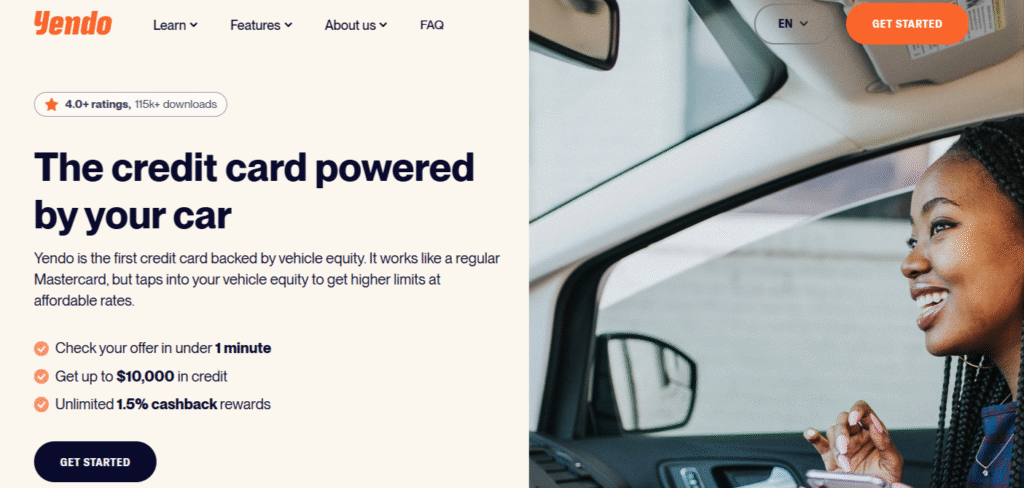

1. What Is Yendo Credit Card?

The Yendo Credit Card is a unique credit-building card designed for people who struggle to qualify for traditional credit cards. Instead of using a cash security deposit like a normal secured card, Yendo uses the value of your car to secure your credit line.

In simple terms:

👉 If you own a car, Yendo allows you to unlock a credit limit using your vehicle’s equity without selling your car, without handing it over, and without taking a loan against it.

You keep driving your car normally.

Why this matters:

Most secured cards ask for a $200–$500 deposit upfront.

Many people don’t have that cash.

Yendo solves that problem by using your vehicle as the security instead.

Key things you get with Yendo:

- A credit line backed by your car’s value

- No hard credit check to apply

- Helps build credit with on-time payments

- Reports to major credit bureaus

- App to manage payments, alerts, and spending

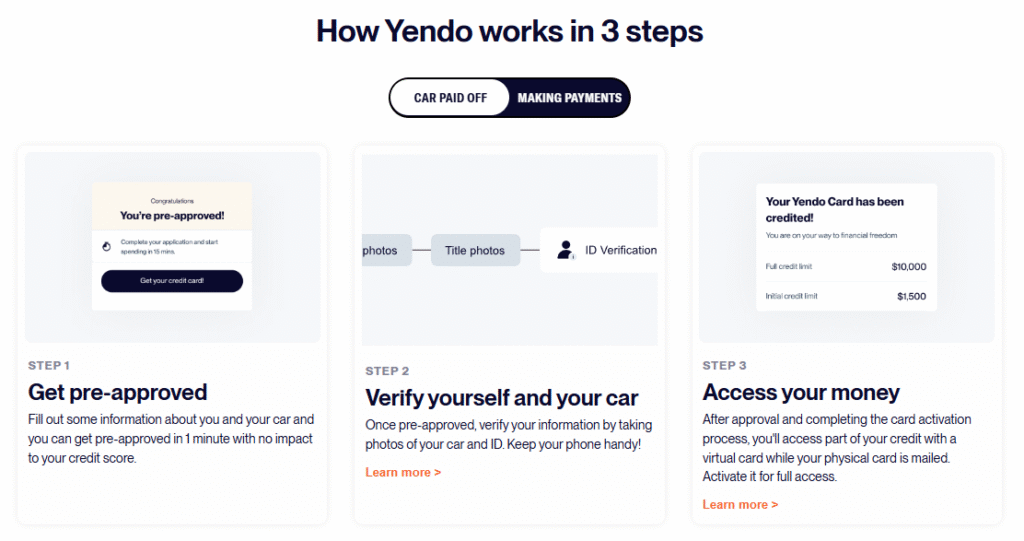

2. How Yendo Works (Step-by-Step)

Understanding how Yendo works is the most important part of this entire review.

People get confused because it’s not a normal credit card and not a traditional auto loan it’s a hybrid model designed mainly for credit building.

Here’s the clearest, simplest breakdown:

⭐ Step 1: You Apply Without a Hard Credit Check

Yendo does not run a hard inquiry.

This means your credit score won’t drop during application.

They check your identity, income, and basic details that’s it.

Perfect for people with:

- Low credit

- No credit history

- Credit recovery stage

⭐ Step 2: Yendo Evaluates Your Car’s Value

This is the unique part.

Instead of asking for a security deposit, Yendo uses your car as collateral.

You still drive your car normally nothing changes in your daily life.

They look at:

- Car model

- Car year

- Condition

- Market value

⭐ Step 3: You Get a Credit Line Backed by Your Car

Once approved, Yendo gives you a credit limit based on the equity in your car.

This works like a secured credit card but the “security” is your vehicle, not cash.

Example:

If your car’s value supports a $600 limit, that becomes your credit line.

⭐ Step 4: Use the Card Anywhere Mastercard Is Accepted

The Yendo card works just like any normal credit card.

You use it for:

- Groceries

- Gas

- Online purchases

- Everyday expenses

Whatever you spend becomes your revolving balance.

⭐ Step 5: Make Monthly Payments Like a Normal Credit Card

Each month, you repay your balance (minimum or full).

Yendo reports your payments to all major credit bureaus.

This is how your credit score improves.

Important:

On-time payments help you build credit.

Late payments can hurt your score.

⭐ Step 6: Yendo Reports to Credit Bureaus

Yendo sends your repayment activity to:

- Experian

- Equifax

- TransUnion

This is what makes it a credit builder.

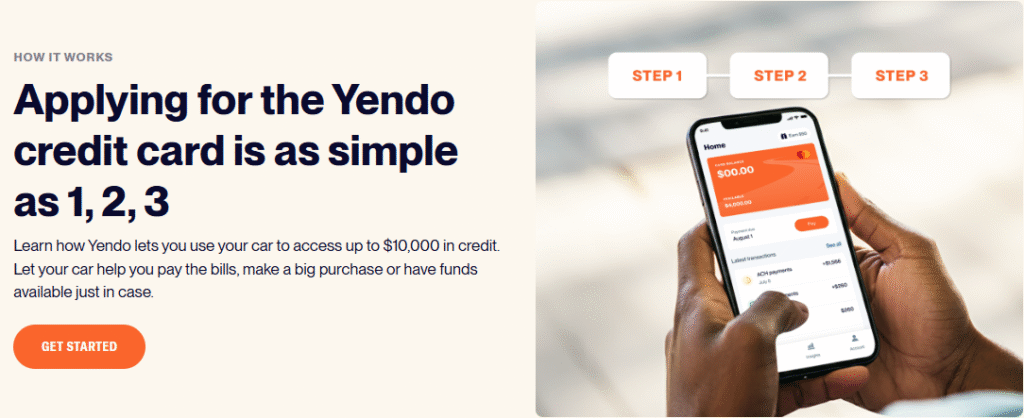

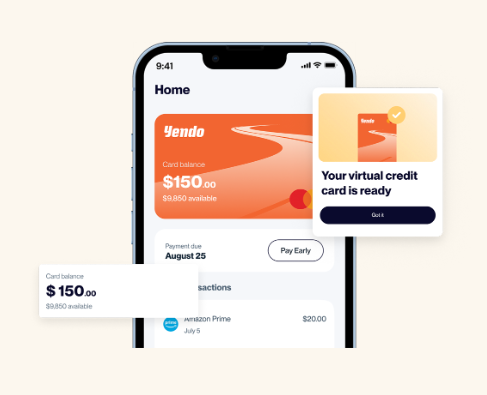

⭐ Step 7: App Experience – Manage Everything in One Place

You can track everything inside the Yendo app:

- Credit limit

- Due dates

- Remaining balance

- Payment alerts

- Transaction history

- Credit-building progress

The app is clean and beginner-friendly.

3. Is Yendo Legit? (Safety, Trust & Red Flags)

When people search “Yendo credit card review,” the biggest question in their mind is the same:

“Is Yendo really legit or some kind of trap?”

Let’s break this down clearly, without hype, without fear just facts.

⭐ Yes, Yendo Is a Legit Company – Here’s Why

✔ Real company with public information

Yendo is a registered U.S.-based financial company with a clear business model and verifiable ownership.

Their platform, app, and support channels are active and monitored.

✔ No hard credit check

This matches what legitimate credit-building services offer safe for people with low or no credit.

✔ Reports payments to all three credit bureaus

This is an important legitimacy marker.

Scammers never report to bureaus only regulated, compliant companies do.

✔ Clear terms, APR, and fees disclosed upfront

Their pricing structure is not hidden.

Everything is available on their website and app before you apply.

✔ Widely reviewed online

Sites like TheBudgetDiet, Reddit discussions, and user forums have real reviews both positive and negative.

A scam usually has no footprint online.

Yendo Red Flags 🚩

- Uses your car as collateral — this isn’t a normal credit card, and defaulting carries higher risk.

- Higher APR than many secured cards — carrying a balance can get expensive.

- Car must meet value requirements — older or low-value vehicles may qualify for a small limit.

- Not a rewards card — it’s strictly for credit-building, not perks or high spending.

4. Yendo Fees, APR & Credit Reporting (New Refreshed Format)

A. Quick Snapshot: What Does Yendo Cost?

Think of Yendo as simple to use but not the cheapest if you carry a balance.

| Feature | What You Need to Know |

|---|---|

| Security Deposit | ❌ No cash deposit needed (your car acts as collateral) |

| APR | Higher than most secured cards → best if you pay full balance monthly |

| Annual Fee | Depends on your plan (check inside the app/website) |

| Late Fee | Yes, if you miss the due date |

| Credit Reporting | ✔ Reports to Experian, Equifax, TransUnion |

B. Fee Breakdown (Humanized Version)

1. No Deposit Required

Most secured cards force you to lock $200–$500.

Yendo replaces that with the equity of your car so you start with a credit limit without blocking cash.

2. APR: The Part You Must Pay Attention To

APR is higher than average.

If you pay your full balance every month → you avoid interest completely.

If you carry a balance → it gets expensive.

Best strategy:

Use Yendo only for small purchases you can repay fully.

3. Additional Fees

Depending on your usage, you may see:

- Late payment fees

- Returned payment fees

- Possible admin or processing charges

(Exact $ amounts depend on the latest Yendo terms.)

C. How Yendo Builds Credit (The Real Benefit)

Yendo reports your monthly activity to all major credit bureaus:

✔ Experian

✔ Equifax

✔ TransUnion

This means your score improves when you:

- Pay on time

- Keep your balance low

- Use the card regularly

Your score can drop if you:

- Miss payments

- Max out your limit

- Carry high balances for long periods

In short:

Yendo can genuinely build credit if you use it responsibly.

D. Hidden Costs? Not Exactly – But Here’s What People Miss

These aren’t “hidden,” but many users ignore them:

- High APR when carrying a balance

- Late fees

- Car being used as collateral (risk factor if you default)

So the card isn’t “expensive,” but it punishes late payments harder than traditional secured cards.

5. Yendo Credit Card: Pros & Cons

| Pros | Cons |

|---|---|

| No upfront deposit required – Your car’s equity works as collateral instead of blocking $200–$500. | High APR if you carry a balance – Interest becomes expensive if you don’t pay in full. |

| Builds credit fast – Reports on-time payments to all three major credit bureaus. | Car used as collateral – Missing payments carries more risk than a normal secured card. |

| No hard credit check – Ideal for low/no credit users. | Not for rewards users – No cashback or travel benefits. |

| Higher credit limit potential – Limit depends on car value, not your savings. | Car eligibility required – Older or low-value cars may get low limits or ineligibility. |

| Easy-to-use mobile app for payments & alerts | Late/returned payment fees apply – Can hurt finances + credit score. |

6. Who Should Use Yendo & Who Should Avoid It?

Yendo is a strong fit for people who need a credit line but don’t have extra cash for a security deposit.

If you own a car with reasonable value, want to build credit without a hard credit check, and can reliably pay your bill on time every month, Yendo gives you a simple way to start improving your score.

It’s mainly built for beginners, credit-rebuilders, and people who want a straightforward card managed through an easy mobile app.

However, it isn’t ideal for anyone who regularly carries a balance, forgets due dates, or wants cashback and rewards.

The higher APR makes revolving balances expensive, and since your car is tied to the account, missed payments can create additional stress.

People with very old or low-value vehicles may also receive lower limits or may not qualify at all.

7. Eligibility & Requirements

Getting approved for Yendo is much simpler than applying for most credit cards. You don’t need a strong credit score or a big cash deposit Yendo mainly looks at your identity, income, and the value of your car.

📈 No Hard Credit Check

One of Yendo’s strongest advantages is that it does not run a hard inquiry.

This means:

- Your credit score stays untouched

- People with low credit or no history can apply

- Approval depends more on your car than your score

8. Yendo vs Secured Credit Cards (Comparison Table)

This is one of the most important sections because users searching for “Yendo credit card review” almost always want to know how it compares to a traditional secured card.

Here’s a clean, useful, SEO-friendly comparison table:

Yendo vs Traditional Secured Credit Cards

| Feature | Yendo Credit Card | Traditional Secured Credit Card |

|---|---|---|

| Deposit Needed | No cash deposit (car equity used as collateral) | Requires $200–$500 refundable deposit |

| Credit Check | No hard credit check | Often requires a hard or soft pull |

| Credit Limit | Based on car value (can be higher) | Equal to your cash deposit |

| Approval Difficulty | Easier, depends mainly on car ownership | Moderate, depends on credit history + deposit |

| Risk Factor | Car is tied to the card; missed payments can increase risk | Only your deposit is at stake |

| Fees & APR | Higher APR if balance is carried | Typically lower APR than Yendo |

| Best For | People without savings for a deposit / credit rebuilders | People who can afford the deposit and want a safer start |

| Rewards | No cashback or perks | Some secured cards offer small rewards |

| Credit Reporting | Reports to all major bureaus | Reports to all major bureaus |

Conclusion

The Yendo Credit Card is not a typical credit card, and that’s exactly why it works for the right person.

If you don’t have the cash for a traditional secured-card deposit but you do have a car with decent value, Yendo gives you a practical way to access a real credit line and start building your score. It removes the stress of hard credit checks and opens the door for people who usually get rejected by banks.

But it also comes with responsibility. The APR is higher, your car is tied to the account, and late payments can create more pressure than a normal deposit-based card. So Yendo only makes sense if you’re someone who pays bills on time and doesn’t carry balances.

Yendo is a smart credit-building tool for people who:

- want an easy approval process,

- need a credit line without locking cash, and

- can manage their payments responsibly.

It’s not ideal for those looking for rewards, long-term balances, or a risk-free experience.

In short: If your goal is credit improvement and you’re disciplined, Yendo can help. If not, a traditional secured card is a safer choice.

“RELATED ARTICLES”

Ultra Debt Relief Review 2025: Is It Legit & Worth It?

Sezzle Review 2025: Is This BNPL App Really Worth It?

FAQs

1. Does using my car as collateral mean Yendo can take it?

Only if you stop paying for a long period. Normal, on-time usage has no impact on your car.

2. How quickly can Yendo improve my credit?

Most users see positive reporting within 1–3 months if they pay on time and keep balances low.

3. Does Yendo require perfect car condition?

No, but the car must have reasonable value and a clean title to qualify for a usable credit limit.

4. Can I increase my credit limit with Yendo?

Yes your limit can be adjusted based on your car’s value and repayment behavior over time.

5. Is Yendo better than a secured card?

It depends: Yendo is better if you don’t have cash for a deposit. Secured cards are better if you want lower APR and zero collateral risk.