Struggling with unexpected bills or emergency expenses? You’re not alone. EncoreLoan promises a simple, fast, and stress-free way to get the funds you need all from your phone or laptop. 💬

🚀 In this review, we’ll dive deep into how EncoreLoan really works, what makes it different from other loan platforms, and whether it’s truly worth your trust in 2025.

💡 Stay with us till the end because the truth about online loans isn’t always what it seems.

What Is EncoreLoan?

EncoreLoan is not a direct lender; it’s a loan-matching marketplace.

Instead of giving you the loan itself, EncoreLoan connects your application to multiple verified lenders in its partner network. Within minutes, you may receive several loan offers and can choose the one that fits best.

In short:

EncoreLoan acts like a personal-loan broker helping borrowers compare multiple lenders through a single, secure form.

Types of Loans Available

- Personal loans (up to $35,000)

- Installment loans with flexible repayment

- Payday-style loans for quick cash needs

- Emergency loans for bills or repairs

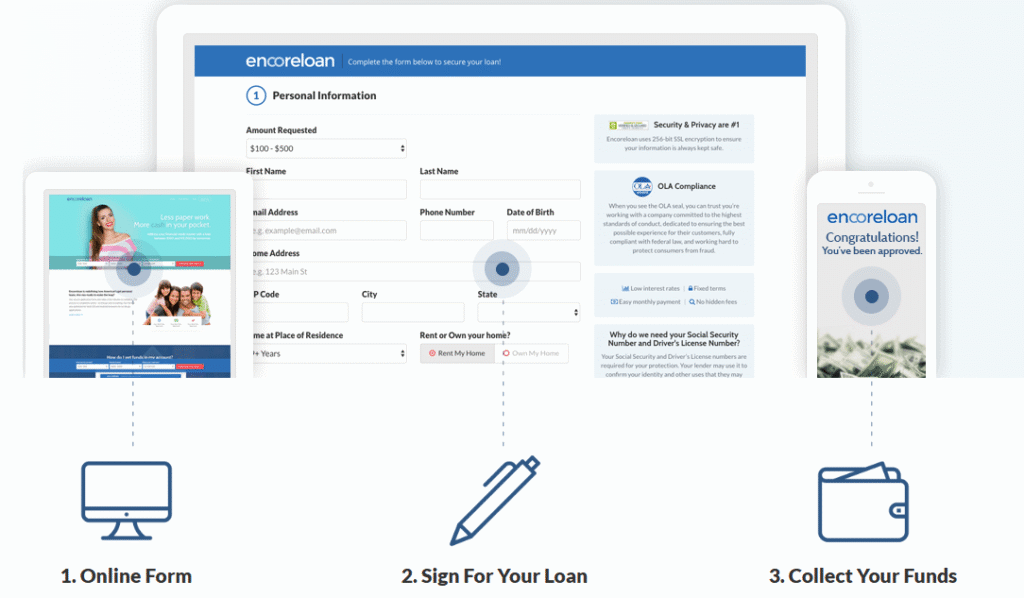

⚙️ How the EncoreLoan Loan Process Works

EncoreLoan’s process is designed to make borrowing simple and fully online no paperwork, no office visits.

According to the official website, the process works in three simple steps:

1️⃣ Online Form: Fill out a secure form on your phone or computer it only takes a few minutes.

2️⃣ Sign For Your Loan: Get matched with a lender and sign your agreement online in minutes.

3️⃣ Collect Your Funds: Receive funds in your bank account as early as the next business day sometimes even sooner.

💡 Loan amounts typically range between $100 and $15,000, depending on your eligibility and lender terms.

👉 Get Your Personalized Quote Now

💰 What Can You Use an EncoreLoan For?

EncoreLoan personal loans are flexible meaning you can use them for nearly any financial need.

According to the official website, borrowers often use their funds for:

- 💳 Debt Consolidation: Combine multiple debts into one manageable payment.

- ⚡ Unexpected Expenses: Handle surprise costs like car repairs or utility bills.

- 🏠 Home Improvement: Upgrade or repair your home without waiting for bank approval.

- 🛍️ Major Purchases: Finance big buys such as electronics or furniture with easy installments.

- 🏥 Medical Expenses: Cover unplanned healthcare costs not covered by insurance.

- ✈️ Vacations or Travel: Take that long-awaited trip and repay gradually.

💡 The platform emphasizes quick access to funds for any of these needs, helping borrowers meet short-term financial goals smoothly.

🌟 Top EncoreLoan Features and Benefits

EncoreLoan was designed to make borrowing money online simple, transparent, and fast.

Unlike traditional banks that ask for endless paperwork and take days to approve a loan, EncoreLoan offers a digital-first approach that helps borrowers find funds within hours even if they have less-than-perfect credit.

Let’s explore its six most impactful features 👇

⚡ 1. Fast and Effortless Application Process

EncoreLoan understands that financial emergencies don’t wait. That’s why the application form is short, direct, and beginner-friendly.

Borrowers only need to enter basic information such as their income, job details, and bank account it usually takes under five minutes to complete.

Once you submit, the system immediately checks lender availability no paperwork, no phone calls, and no unnecessary questions.

💵 2. Lightning-Fast Approval and Next-Day Funding

EncoreLoan’s system automatically scans through a network of trusted lending partners and matches you with those most likely to approve your request.

Once a match is found, some lenders approve loans within minutes, and funds can reach your account in as little as 24 hours.

💳 3. Soft Credit Check: No Risk to Your Credit Score

EncoreLoan runs only a soft credit check when you apply. This means checking your eligibility won’t affect your credit score.

A hard credit inquiry happens only after you choose a lender and decide to finalize your loan.

🧾 4. Multiple Loan Offers With a Single Form

This is one of EncoreLoan’s biggest strengths.

Instead of applying to ten different lenders, you fill out one form and EncoreLoan automatically shows you multiple offers from licensed lenders that match your profile.

Each offer includes details like:

- Loan amount

- Repayment term

- APR (Annual Percentage Rate)

- Fees and conditions

You can compare everything side-by-side and pick the one that best fits your needs and repayment comfort.

🔒 5. Secure, Transparent, and Privacy-Focused

EncoreLoan takes security seriously. The platform uses bank-grade SSL encryption to protect sensitive personal and financial data.

It also has a clear Privacy Policy and never asks users for payments or sensitive documents during the matching process.

All lender interactions happen on secure portals, and borrowers can review full loan terms before signing anything.

📱 6. Mobile-Friendly and 24/7 Accessibility

EncoreLoan is built for convenience. The entire process from applying to reviewing offers works seamlessly on any device, including smartphones and tablets.

There’s no need to download an app or wait for business hours.

You can apply on your lunch break, late at night, or even while traveling. The website adjusts perfectly to your screen and walks you step-by-step through the process.

👥 Who Is EncoreLoan Best For?

EncoreLoan isn’t made for everyone it’s designed for people who want speed, flexibility, and convenience when borrowing money online.

If any of the situations below sound like you, EncoreLoan can be a practical fit 👇

💸 1. Borrowers Who Need Money Fast

If you’re facing an emergency like a medical bill, car repair, rent, or utility payment EncoreLoan’s same-day or next-day funding can help.

Unlike traditional banks that take days to approve, EncoreLoan connects you with lenders in minutes.

💳 2. People With Bad or Limited Credit History

EncoreLoan is known for being friendly to low-credit borrowers.

Even if your credit score is below average, you still have a fair chance of approval through its partner lenders. Some even specialize in “bad credit loans.”

⚙️ 3. Borrowers Who Want to Compare Multiple Lenders

Many people waste time applying separately to several lenders each with different requirements.

EncoreLoan removes that friction by showing multiple offers through one application.

🕒 4. People Who Want to Save Time

If you don’t have the patience or experience to deal with traditional banks, EncoreLoan’s quick digital process is a lifesaver.

You don’t need to print forms, meet representatives, or wait for callbacks.

🏠 5. Borrowers Who Need Flexible Loan Usage

EncoreLoan doesn’t limit how you use the money. Whether it’s medical bills, education fees, home repairs, or consolidating credit card debt the choice is yours.

🧑💼 6. Self-Employed or Freelance Professionals

Traditional banks often hesitate to approve freelancers or gig-workers because of irregular income.

EncoreLoan’s partner lenders look at overall financial stability, not just fixed monthly salaries.

Who Should Avoid EncoreLoan?

EncoreLoan isn’t the best fit for everyone. It’s better to skip it if you fall under these categories: 🚫

- ❌ No Bank Account: Funds can only be transferred to a verified checking account.

- ⚠️ Good-Credit Borrowers: If you qualify for low-interest bank loans, those are cheaper.

- 🚷 Restricted States: EncoreLoan doesn’t operate everywhere check coverage first.

- 💰 Tight Budgets: Late payments can trigger high fees and interest growth.

- 📅 Long-Term Borrowers: Not suitable for big, long-term loans like car or home financing.

- 😕 Rushed Applicants: Those who don’t compare offers carefully may end up paying more.

👉 Summary:

Avoid EncoreLoan if you can already get affordable credit elsewhere or struggle to repay on time.

👉 Get Your Personalized Quote Now

⚖️ EncoreLoan Pros and Cons

Every loan platform has its strengths and drawbacks. Here’s a balanced look at what EncoreLoan does well and where it may fall short 👇

| ✅ Pros | ❌ Cons |

|---|---|

| Fast and simple application — Takes just minutes to apply online, no paperwork required. | High interest for bad credit — APRs can be steep depending on your score and lender. |

| Quick funding — Most users receive money within 24 hours of approval. | Not a direct lender — EncoreLoan can’t control exact loan terms or rates. |

| Soft credit check — Checking eligibility won’t affect your credit score. | Limited state availability — Some users may not qualify based on location. |

| Multiple offers in one form — Compare loan options from several lenders easily. | Marketing emails — You might receive offers from partner lenders after applying. |

🔄 EncoreLoan vs Competitors

To see where EncoreLoan stands, let’s compare it with two similar loan platforms LendJet and NetLoanExpress 👇

| Feature | EncoreLoan | LendJet | NetLoanExpress |

|---|---|---|---|

| Application Process | Single form connects to multiple lenders | Limited network, basic form | Quick single-lender process |

| Funding Speed | Up to 24 hours | 1–2 business days | Same-day funding possible |

| Credit Requirements | Accepts poor credit | Requires fair credit | Accepts bad credit, higher APR |

| Loan Range | $500–$35,000 | $300–$10,000 | $200–$5,000 |

| Transparency | Full cost shown before approval | Average | Varies by lender |

| Availability | Many states covered | Fewer states | Limited to select regions |

🔍 Is EncoreLoan Legit or a Scam?

EncoreLoan is a legitimate loan-matching service, operating since 2013 and working with state-licensed lenders.

It uses SSL encryption and has a transparent privacy policy no hidden fees or up-front charges.

However, stay alert:

- Only use the official EncoreLoan website.

- Never send money to “secure approval.”

- Ignore fake emails offering instant loans EncoreLoan does not cold-contact applicants.

✅ Registered domain with privacy policy

✅ Secure HTTPS connection

✅ Partners with licensed U.S. lenders

Is EncoreLoan Worth It in 2025?

In 2025, EncoreLoan remains a compelling choice for borrowers who need fast, flexible, and accessible online loans especially when traditional banks are out of reach. Its key advantages are:

- The ability to apply quickly online without paperwork

- Soft credit checks, so your score stays safe during comparisons

- Access to multiple loan offers in one place

- Transparency and security, with clear terms and encrypted data

However, it’s not perfect. Because it matches you with lenders (rather than lending itself), APRs and actual costs depend heavily on your credit profile. Some users may face high interest rates, limited state availability, or short repayment terms.

So, when is EncoreLoan worth it?

- If you have an urgent expense and can’t wait for traditional loan approval

- If your credit is less than perfect, but you still want options

- If you’re willing to carefully compare offers and pick one you can repay

And when might you skip it?

- If you qualify for low-rate bank or credit union loans

- If you don’t live in a state where EncoreLoan’s lenders operate

- If you can’t comfortably make timely repayments the risk of compounding fees is real

Final Verdict:

EncoreLoan is legit and useful for the right users. It’s not the cheapest option, but for those needing speed and flexibility, it’s a viable tool as long as you borrow smartly and read every offer carefully.

👉 Get Your Personalized Quote Now

FAQs ❓

Q1. Does EncoreLoan offer joint loans?

A: No, EncoreLoan doesn’t currently support joint applications. Only individual borrowers can apply.

Q2. Can I apply for a second loan while one is active?

A: Usually not. Most lenders require you to repay your current loan before approving another.

Q3. Does EncoreLoan charge any application fee?

A: No, applying through EncoreLoan is completely free. You only deal with lender fees if your loan is approved.

Q4. Can I cancel my application after submitting it?

A: Yes, you can choose not to proceed with any lender offer. There’s no penalty for canceling before signing.

Q5. What documents do I need to apply?

A: Basic ID, proof of income, and active bank account details are usually enough.