Pet insurance used to mean paperwork, delays, and hidden terms. Lemonade has completely changed that experience bringing speed, transparency, and customization into a single, app-driven platform.

Whether you have a curious kitten or a playful pup, Lemonade offers flexible coverage that you can manage directly from your phone — from getting a quote to receiving reimbursements in minutes.

Let’s take a deep dive into what makes Lemonade one of the most talked-about pet insurance providers of 2025.

What Is Lemonade Pet Insurance?

Lemonade Pet Insurance is a modern, tech-driven way to protect your furry family members from unexpected vet bills. Unlike traditional insurers that rely on piles of paperwork and slow claim approvals, Lemonade uses artificial intelligence to make everything faster and simpler.🐶

You can sign up in just a few minutes through their website or mobile app, customize your plan for dogs or cats, and get reimbursed quickly sometimes within seconds when you file a claim. 🕒

What makes Lemonade stand out is its transparent pricing, AI-powered claim process, and social impact model they donate leftover money to animal charities through their annual Giveback program. It’s designed for today’s pet owners who want protection without the old-school hassle.

🌟 Key Features of Lemonade Pet Insurance

Lemonade isn’t your typical pet insurance company. It combines modern technology, fair pricing, and a refreshing transparency that’s hard to find in traditional insurers. Let’s break down its most important features and what makes each one stand out 👇

🧠 1. AI-Powered Claims Process

Lemonade uses artificial intelligence to process claims in minutes sometimes seconds. You just open the app, record a short video explaining what happened, and submit your claim. The AI reviews your documents instantly, and if everything checks out, the money is deposited right into your account.

💬 This means no more weeks of waiting or endless paperwork.

💸 2. Customizable Coverage Plans

Every pet (and owner) is different and Lemonade gets that. You can easily adjust your deductible, reimbursement rate (70%, 80%, or 90%), and annual limit to fit your budget.

💡 It’s a flexible setup pay less if you want lower coverage or pay more for full protection.

🩺 3. Preventative Care Add-Ons

Lemonade offers an optional Preventative Care package that covers routine checkups, annual exams, blood tests, and vaccines. It’s ideal for proactive pet parents who want to keep their pets healthy rather than just react to emergencies.

🐾 It’s not mandatory, but it can save you hundreds each year on regular vet visits.

🦷 4. Dental Illness Coverage

Dental care can get expensive fast. Lemonade gives you the option to add dental illness coverage, which helps pay for issues like gum infections, tooth extractions, or oral surgeries.

😺 This is a rare benefit many competitors only cover dental accidents, not illnesses.

🧍♀️ 5. Physical Therapy & Holistic Care

After surgeries or injuries, pets often need rehabilitation. Lemonade’s extended coverage includes physical therapy, acupuncture, and hydrotherapy to speed up recovery.

💬 It’s especially useful for senior pets or breeds prone to joint problems.

💖 6. Fast Online Experience

Everything from getting a quote to managing your policy happens online or in the Lemonade app. You can check claims, view coverage, or update details in just a few taps.

📱 It’s designed for people who prefer simplicity and speed.

🐾 7. Lemonade Giveback Program

Lemonade takes a flat fee from your premium and uses leftover money to donate to animal-related charities through its Giveback initiative.

🌍 So, you’re not just protecting your pet you’re helping others too.

👉 Get Your Personalized Quote Now

💸 How Much Does Lemonade Pet Insurance Cost in 2025?

Lemonade keeps pricing transparent but personalized. Policies for dogs or cats start at around $10/month, but your exact premium is calculated after filling out a quick online quote form.

To get an accurate price, you’ll need to share your:

- 🐾 Pet type (dog or cat)

- 📍 Location (since vet costs differ by state)

- 🐶 Pet’s breed, age, and overall health condition

Once you enter these details, Lemonade instantly shows your personalized monthly premium and lets you adjust the deductible, annual coverage limit, and reimbursement rate so you can find the perfect balance between affordability and protection.

🐕 Average Cost for Dogs

If you have a 4-year-old Goldendoodle in Chicago, with 80% co-insurance, the maximum annual limit, and a $250 deductible, your average monthly cost would be $61.

| Insurance Provider | Average Monthly Cost |

|---|---|

| Trupanion | $336 |

| Healthy Paws | $85 |

| Pets Best | $77 |

| Many Pets | $73 |

| Fetch | $99 |

| Lemonade | $61 |

On average, across different dog breeds and states, Lemonade pet parents pay around $48/month to keep their dogs protected.

🐈 Average Cost for Cats

For a 1-year-old short-haired cat in Danbury, Connecticut, with an 80% co-insurance, $250 deductible, and maximum annual limit, the cost is about $29/month.

| Insurance Provider | Average Monthly Cost |

|---|---|

| Trupanion | $58 |

| Pets Best | $35 |

| Many Pets | $44 |

| Fetch | $36 |

| Lemonade | $29 |

Across all states and breeds, cat owners pay an average of $27/month for Lemonade’s coverage.

🗺️ Average Cost by State (Lemonade Data)

Lemonade’s pet insurance pricing depends on where you live, due to regional vet cost differences.

| State | Average Monthly Range |

|---|---|

| California | $45–$49 |

| New York | $40–$44 |

| Florida | $35–$39 |

| Texas | $30–$34 |

| Arizona | $35–$39 |

| Iowa | $25–$29 |

💡 Your premium changes based on vet costs and location, but Lemonade always keeps the process transparent — you’ll see your exact rate instantly after submitting the quote form.

⚙️ What Factors Impact Lemonade Pet Insurance Cost?

Several factors influence your quote here’s what matters most:

- 🐾 Pet Type: Cats are usually cheaper to insure than dogs.

- 🎂 Age: Older pets require more care, which increases monthly costs.

- 🐶 Breed: Certain breeds are prone to hereditary issues like hip dysplasia or asthma.

- 📍 Location: Vet costs in big cities like New York or Los Angeles are higher than in smaller towns.

- 📊 Coverage Choices: Your selected deductible, co-insurance rate (70%, 80%, or 90%), and annual limit ($5,000 to $100,000) affect your premium directly.

💬 Pro tip: If you want a lower monthly price, choose a higher deductible or a lower reimbursement rate.

🧩 What Does Lemonade Pet Insurance Cover?

Lemonade’s standard policy helps cover expenses related to accidents and illnesses, ensuring you’re not left with massive vet bills when unexpected issues arise.

Covered areas include:

- 💉 Diagnostics: Blood tests, X-rays, CT scans, MRIs, and lab work

- 🏥 Procedures: Emergency visits, surgeries, hospitalization, and specialty care

- 💊 Medications: Prescriptions, injections, and ongoing treatments

A policy like this helps you prepare for unpredictable situations from broken bones and infections to long-term illnesses.

➕ Optional Add-Ons and Preventative Plans

Lemonade offers optional Preventative Care packages to help you manage everyday wellness needs:

- Preventative Package – Covers vaccines, wellness exams, heartworm tests, and fecal tests.

- Preventative+ Package – Includes everything in the basic plan plus routine dental cleanings and bloodwork.

- Puppy/Kitten Preventative Package – Designed for young pets; covers spaying/neutering, microchipping, flea and heartworm prevention.

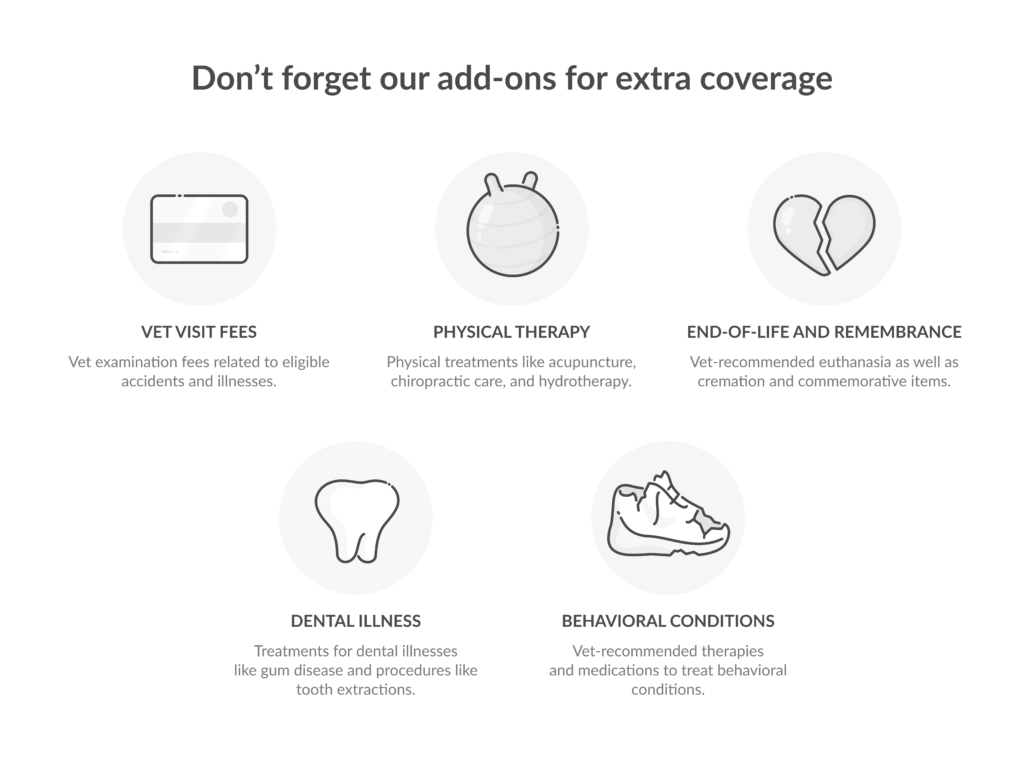

In addition, Lemonade offers five add-on options for broader protection:

- Vet visit fees after an accident or illness

- Physical therapy and rehab (acupuncture, hydrotherapy)

- Dental illness coverage (root canals, tooth extractions)

- Behavioral conditions (anxiety, aggression)

- End-of-life and remembrance (euthanasia, cremation, memorial items)

💬 These add-ons make Lemonade’s plans flexible enough for nearly any pet owner’s needs.

🚫 What Lemonade Pet Insurance Doesn’t Cover

Even the best insurance has limits. Lemonade clearly lists what isn’t included so pet owners know exactly what to expect.

🩺 Pre-Existing Conditions

Any illness, injury, or symptom that appears before your policy starts or during the waiting period isn’t covered. Example: if your pet was treated for allergies before enrollment, future allergy treatments won’t be reimbursed.

🚫 Preventable or Neglect-Related Issues

Lemonade won’t cover conditions caused by lack of care or unsafe environments, such as skipped vaccinations or untreated infections. The policy is designed for unexpected incidents, not avoidable ones.

💅 Cosmetic & Elective Procedures

Non-medical treatments like grooming, cosmetic surgeries, or declawing aren’t covered. Only vet-required medical procedures qualify.

🏠 Training, Boarding & Travel

Expenses unrelated to medical care such as obedience training, boarding, daycare, or travel fees are excluded.

(Vet-recommended behavioral therapy may be covered if you add the behavioral conditions add-on.)

⏱️ Waiting Period Conditions

Illnesses or accidents that occur during the initial waiting period (2 days for accidents, 14 days for illnesses) aren’t eligible for reimbursement.

Lemonade Pet Insurance Pros & Cons👍👎

After evaluating Lemonade Pet Insurance in detail, our team at SmartFundsAdvisor summarized the main advantages and drawbacks based on overall coverage, pricing, and user experience.

| Pros | Cons |

|---|---|

| ⚡ Claims are processed within minutes through Lemonade’s AI-powered system | ❌ Does not cover pre-existing conditions |

| 💰 Affordable monthly premiums for both cats and dogs compared to national averages | 📞 Limited customer support mostly app and chat-based |

| 📱 100% digital experience with easy-to-use mobile app | 🐾 Coverage available only for cats and dogs (no exotic pets) |

| 🧾 Customizable plans choose your deductible, annual limit, and reimbursement rate | 💉 Routine care like checkups and vaccines requires an add-on plan |

| ❤️ Transparent policies and social impact through Lemonade’s Giveback program | 📈 Premiums may increase as your pet gets older |

👉 Get Your Personalized Quote Now

💰 Example: How Lemonade Claims Work

Scenario: Your dog, Mogley, needs knee surgery that costs $6,000.

Your policy has 80% co-insurance and a $250 annual deductible.

How the reimbursement is calculated:

- Lemonade pays the co-insurance portion:

$6,000 × 80% = $4,800 - Your deductible applies (because it hasn’t been met yet):

$4,800 − $250 = $4,550 reimbursed by Lemonade

Your out-of-pocket on this claim:

$6,000 total bill − $4,550 reimbursement = $1,450

(that $1,450 includes the $250 deductible).

Later in the same year: Mogley needs another procedure costing $1,500.

Your deductible is already met, so Lemonade applies only co-insurance:

- $1,500 × 80% = $1,200 reimbursement

- You pay $300 out of pocket

Key takeaways (in plain English):

- Co-insurance = the percentage Lemonade pays after your deductible (here, 80%).

- Deductible = the amount you pay first each policy year. Once it’s met, it won’t be taken again until the next year.

- You can track every step of a claim inside the app submission, review, approval, and payout so you always know where things stand.

🏥 Which Vets Are Accepted?

Lemonade works on a reimbursement basis, so you can use any licensed veterinarian in the U.S.

How it works:

- Visit any licensed vet you prefer.

- Pay the bill upfront at the clinic.

- Submit the receipt through the Lemonade mobile app.

- Lemonade reviews the claim and reimburses you for eligible costs according to your policy terms.

There’s no in-network requirement to worry about choose the vet that’s best for your pet.

💡 How to Lower Your Premium

Lemonade lets you adjust key parts of your policy to control what you pay each month:

- Increase your deductible (choices include $100, $250, $500, or $750)

– Higher deductible = lower monthly price, but more out-of-pocket when you claim. - Lower your co-insurance (options include 90%, 80%, or 70%)

– Lower co-insurance = lower monthly price, but Lemonade reimburses a smaller share per claim. - Choose a smaller annual limit (from $5,000 up to $100,000)

– Lower limit = lower monthly price, but less total coverage available in a year.

In most states*, you can request coverage downgrades (like increasing the deductible or reducing co-insurance) during the policy period.

*Not available in New Hampshire or California.

⚙️ How Fast Are Lemonade Claims?

Lemonade’s claim experience is app-based and streamlined.

- For simple claims (like straightforward wellness items or basic treatments), approvals can happen within minutes.

- More complex claims can take a few business days while the team reviews medical details.

- Throughout the process, the app keeps you updated no phone calls or paperwork required.

It feels much closer to using a modern app than dealing with traditional insurance workflows.

🐕 Lemonade vs Other Pet Insurance Providers

At SmartFundsAdvisor, we compared Lemonade with some of the top-rated pet insurance providers in 2025, including Trupanion, Embrace, and Healthy Paws.

Our analysis focused on pricing, claim speed, app experience, and overall value for money.

Here’s how Lemonade stacks up against the competition 👇

| Feature | Lemonade | Trupanion | Embrace | Healthy Paws |

|---|---|---|---|---|

| 💰 Starting Price | From $15/mo (cats) / $25/mo (dogs) | Around $35/mo | Around $20/mo | Around $30/mo |

| ⚡ Claim Speed | Minutes (AI-based) | 5–10 days | 2–3 days | 3–5 days |

| 📱 Mobile App | Excellent, full control | Basic | Good | Good |

| 🧾 Customization Options | High – choose deductible, limit, reimbursement | Moderate | High | Moderate |

| 🐾 Preventative Care Add-on | Yes | No | Yes | Yes |

| ❤️ Charity / Giveback Program | Yes | No | No | No |

| 📞 Customer Support | Chat + Email | Phone + Email | Phone + Chat | Phone + Chat |

| 🔒 Coverage Transparency | Very clear | Complex | Clear | Moderate |

💬 SmartFundsAdvisor Analysis:

Lemonade clearly wins in terms of affordability, claim speed, and digital experience. It’s perfect for pet owners who prefer a modern, app-based approach and quick reimbursements.

🧠 Final Verdict

After reviewing Lemonade’s features, pricing controls, and claim flow, our view is that it’s an excellent fit for tech-savvy pet parents who want a policy they can tailor and manage entirely from their phone.

Why we like it

- 🕒 Fast, app-first claims that keep you informed step by step

- 💰 Clear, customizable pricing using deductible, co-insurance, and annual limit choices

- 📱 Full control via app from quotes to claims

- 🐕 Flexible coverage for dogs and cats, plus targeted add-ons for broader protection

- ❤️ Optional preventative and specialty add-ons to round out care

Where it could improve

- Lacks phone-first support for those who prefer calling

- May be less ideal for older pets or cases needing very extensive, ongoing care

Bottom line: Lemonade offers a smart, flexible, and affordable way to insure your pet built for people who value speed, simplicity, and transparency.

👉 Get Your Personalized Quote Now

❓ FAQs About Lemonade Pet Insurance

1. Does Lemonade cover pre-existing conditions?

No. Like most insurers, any illness or injury that occurred before your coverage began isn’t covered.

2. How fast does Lemonade pay out claims?

For simple cases, claims are processed within minutes. More complex claims may take a few business days.

3. Is there a waiting period before coverage starts?

Yes typically 2 days for accidents and 14 days for illnesses after your policy becomes active.

4. Can I include multiple pets under one policy?

You can insure multiple pets, and Lemonade even offers a small multi-pet discount.

5. Does Lemonade cover routine checkups or vaccinations?

Only if you purchase the Preventative Care add-on. The base plan covers accidents and illnesses only.