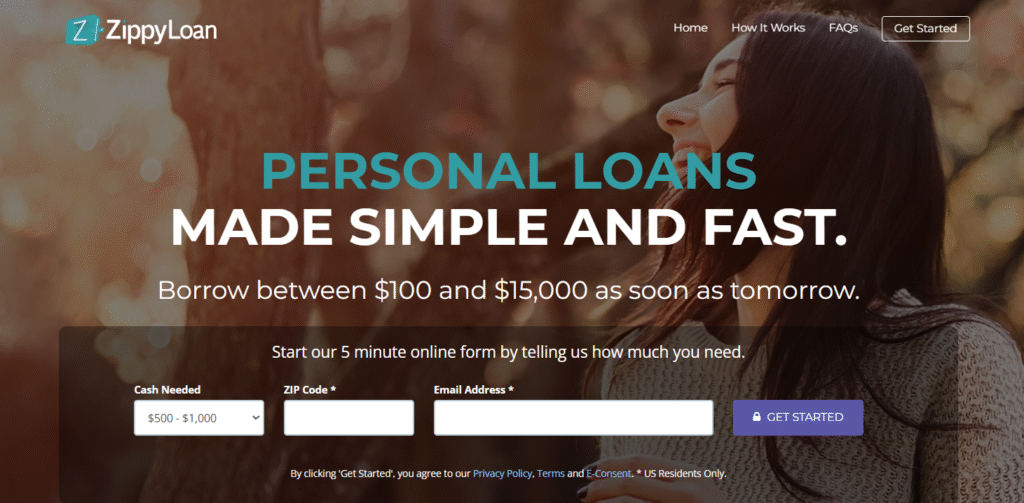

Imagine waking up to an unexpected expense car repair, medical bill, or rent due tomorrow. Most banks will take days, maybe weeks, to process a loan. But what if you could borrow between $100 and $15,000 and get the money as soon as tomorrow?

That’s exactly what ZippyLoan claims to do.

ZippyLoan positions itself as a fast, secure, and simple online loan connection service, helping you access funds through its network of over 100 lenders. But does it really deliver on its promise? Let’s break it down.

🔍 What Is ZippyLoan?

ZippyLoan is an online personal loan marketplace not a direct lender.

It connects borrowers with a large network of licensed lenders across the U.S., offering both short-term and installment loans.

You can borrow from $100 to $15,000, depending on your income, credit profile, and state regulations.

The process is completely online, available 24/7, and designed to match you with a lender who best fits your financial situation.

Key Details:

- Loan amounts: $100 – $15,000

- Loan types: Short-term and Installment

- Repayment terms: Up to 60 months

- Availability: U.S. residents only

- Credit types accepted: Good, fair, and bad credit

⚙️ How ZippyLoan Works Step-by-Step Process

ZippyLoan’s main selling point is speed and simplicity. The company promises you can complete your loan request in under five minutes. Here’s how the process unfolds:

1️⃣ Request Online in 5 Minutes

Fill out a quick form on ZippyLoan’s website with:

- Cash amount needed

- ZIP code

- Email address

You’ll also need your name, address, and income information to submit the request.

The form works on both desktop and mobile (optimized for iOS and Android).

2️⃣ Get Matched with a Lender in Real Time

Once you hit “Get Started,” your request is sent across ZippyLoan’s network of over 100 lenders.

The platform automatically matches you with a lender based on your credit, location, and loan amount.

If approved, you’re redirected to the lender’s site to review and e-sign your agreement.

3️⃣ Receive Your Funds As Soon As Tomorrow

After signing, funds are typically deposited directly into your bank account by the next business day, provided your request is completed before 5 PM CST.

4️⃣ Repay Your Loan

ZippyLoan lenders offer flexible repayment schedules:

- Installment loans: 6–60 months

- Short-term loans: Usually due on your next payday

Some lenders also allow early repayment without penalties.

🌟 Top 6 Key Features of ZippyLoan

⚡ 1. Fast, Real-Time Loan Requests

ZippyLoan uses an advanced matching system that connects borrowers with lenders instantly. Once you submit your loan request, the platform checks your details against its network of over 100 lenders in real time. This eliminates long waits and lets you see potential offers within minutes.

💰 2. Funds Deposited as Soon as the Next Business Day

If your loan is approved before 5 PM CST, funds can be deposited directly into your bank account by the next business day. This quick turnaround is ideal for emergencies such as medical bills, home repairs, or car issues. The entire funding process is electronic no checks or paperwork required.

🧾 3. All Credit Types Accepted

ZippyLoan’s lender network welcomes applicants with all credit scores whether you have excellent, average, or even poor credit. Instead of rejecting based solely on your credit history, lenders consider factors like income stability, employment, and state of residence. This inclusivity gives everyone a fair shot at getting approved.

🔒 4. Secure and Encrypted Platform

Your personal and financial information is protected with 256-bit SSL encryption technology, the same level of security used by major banks. ZippyLoan is also a member of the Online Lenders Alliance (OLA), ensuring compliance with federal standards and consumer protection laws.

💳 5. Flexible Loan Amounts and Terms

Borrowers can request between $100 and $15,000 depending on their financial needs. Repayment terms vary from short-term loans (due by next payday) to installment loans with up to 60 months to repay. This flexibility allows users to choose a plan that fits their budget and repayment comfort.

🕒 6. 24/7 Accessibility

ZippyLoan operates entirely online and is available 24 hours a day, 7 days a week. Whether you’re applying at midnight or during lunch break, the process is always open. The platform is mobile-friendly, making it easy to submit a loan request from your smartphone or tablet without visiting a bank.

🧾 7. 100% Online & Paperless Process

Everything from application to approval happens digitally no paperwork, no faxing, and no in-person meetings. You can e-sign your loan agreement within minutes.

🔁 8. Flexible Repayment Options

Borrowers can choose between short-term or installment loans, with terms ranging from a few weeks to 60 months. Some lenders even allow early payoff without any penalty.

🤝 9. Transparent Lender Matching

ZippyLoan clearly displays your lender’s name and loan details before you accept any offer. You’ll see your APR, monthly payment, and repayment duration upfront no hidden surprises.

🧰 10. Wide Network of 100+ Lenders

Your single loan request is shared across a network of more than 100 verified lenders, increasing your chances of finding a match regardless of credit score or income level.

Loan Eligibility & Requirements

Applying for a loan through ZippyLoan is quick and simple. You only need to meet a few basic conditions to qualify.

✅ Basic Requirements

- Age: Must be 18 years or older

- Residency: Must be a U.S. resident

- Income: Must have a regular source of income (job, self-employment, or benefits)

- Bank Account: Need an active checking account for deposits and repayments

- Contact Info: Must provide a valid email and phone number

💳 Credit Flexibility

ZippyLoan accepts all credit types good, fair, or bad.

Instead of focusing only on credit score, lenders also consider your income and state of residence, giving everyone a fair chance to qualify.

⚙️ Quick Summary

| Criteria | Details |

|---|---|

| Age | 18+ |

| Residency | U.S. only |

| Income | Regular income required |

| Bank Account | Active checking account |

| Credit Score | All credit types accepted |

Loan Types & Repayment Terms

ZippyLoan offers two types of personal loans, giving borrowers flexibility based on their needs and repayment ability.

🧾 Installment Loans

- Loan Amount: $1,000 – $15,000

- Repayment Period: 6 to 60 months

- Payments: Fixed monthly installments

- Best For: Long-term needs like debt consolidation or home improvement

💰 Short-Term Loans

- Loan Amount: $100 – $1,000

- Repayment: Due on your next payday

- Best For: Emergencies or short-term cash shortages

Summary Table

| Loan Type | Amount | Repayment | Ideal For |

|---|---|---|---|

| Installment Loan | $1,000 – $15,000 | 6–60 months | Long-term expenses |

| Short-Term Loan | $100 – $1,000 | Next payday | Urgent expenses |

🔒 Safety & Security

ZippyLoan states clearly that it “utilizes industry-standard security protocol and 256-bit data encryption technology to ensure that your information is secure while using our site.”

Additionally, the website mentions that when you see the Online Lenders Alliance (OLA) seal, you’re “working with a company committed to the highest standards of conduct … dedicated to … protecting consumers from fraud.”

According to ZippyLoan’s Privacy Policy, they take “appropriate and reasonable security measures to help safeguard your personal and sensitive information.” zippyloan.com They use SSL encryption for transmission, which secures your data when entered on their site.

While these are positive signals, it’s worth noting that ZippyLoan clearly states it is not a lender itself, but a referral network connecting borrowers with participating lenders. That means the actual loan approval, terms, and service are done by third-party lenders.

Pros and Cons of ZippyLoan

✅ Pros

- Accepts applicants with all credit types (excellent, fair, or poor).

- Offers loan amounts starting as low as $100 and up to $15,000.

- Very fast access to funds once matched, funding can occur in as little as one business day.

- Fully online application convenient and accessible 24/7.

- No application fee to use ZippyLoan’s platform (though lender fees vary).

⚠️ Cons

- Because ZippyLoan is a matching service, you are not guaranteed to get a lender or the terms you hope for.

- Interest rates may be high, especially for borrowers with poor credit terms depend heavily on the matched lender.

- The platform is not available in all U.S. states, limiting eligibility depending on your location.

- Review complaints: there are several negative user reports, including concerns about unwanted communications and unclear lender terms.

💼 Loan Uses & Flexibility

ZippyLoan gives borrowers complete freedom to use the loan amount for any personal purpose. There are no restrictions on how you spend the money once you’re approved.

💡 Common Ways Borrowers Use ZippyLoan:

- 💳 Debt Consolidation: Combine multiple loans or credit cards into one manageable payment.

- 🚗 Auto Repairs: Fix your car quickly without touching your savings.

- 🏡 Home Improvements: Upgrade or renovate your home with flexible payment options.

- 💊 Medical Expenses: Cover urgent healthcare bills before insurance reimbursement.

- 🎓 Education or Skill Training: Pay for online courses or certifications.

- 💍 Personal Events: Fund weddings, vacations, or other major life moments.

This flexibility makes ZippyLoan useful for both planned expenses and unexpected emergencies.

ZippyLoan vs Other Loan Platforms

Here’s how ZippyLoan compares to similar online loan services based on speed, accessibility, and approval flexibility: ⚖️

| Feature | ZippyLoan | LendingClub | Upstart | Avant |

|---|---|---|---|---|

| Loan Amounts | $100 – $15,000 | $1,000 – $40,000 | $1,000 – $50,000 | $2,000 – $35,000 |

| Credit Accepted | All credit types | Good–Excellent | Fair–Excellent | Fair–Good |

| Funding Speed | Next business day | 3–5 business days | 1–2 days | 1 day |

| Loan Type | Short-term & Installment | Installment | Installment | Installment |

| Availability | U.S. residents only | U.S. residents only | U.S. residents only | U.S. residents only |

👉 Verdict: ZippyLoan stands out for its speed, small-loan flexibility, and acceptance of bad credit, while others like LendingClub and Upstart offer higher maximum limits but stricter requirements.

Repayment & User Example

Repayment through ZippyLoan’s lenders is designed to be simple and flexible. 👩💼

- Installment loans: Repaid monthly over 6–60 months.

- Short-term loans: Paid back on your next payday.

- Early repayment: Most lenders allow it with no penalty.

📘 Real-Life Example

Sarah, a 29-year-old teacher, needed $900 for urgent car repairs. She applied through ZippyLoan and got matched with a lender offering a short-term loan.

She e-signed her agreement in minutes and received funds in her account the next business day. After repaying on time, the lender reported her payments, slightly improving her credit score.

⭐ Final Verdict & Rating

ZippyLoan is a fast, flexible, and legitimate option for people seeking personal loans without going through lengthy bank procedures.

It’s especially useful for those who:

- Need cash urgently

- Have limited or poor credit history

- Prefer a fully online experience

However, since ZippyLoan is a loan-matching platform, the actual loan terms depend on the lender you’re connected with. Always review your agreement carefully before signing.

🔍 Overall Rating: 4.5 / 5

| Category | Rating |

|---|---|

| Ease of Use | ⭐⭐⭐⭐⭐ |

| Speed of Funding | ⭐⭐⭐⭐⭐ |

| Transparency | ⭐⭐⭐⭐ |

| Flexibility | ⭐⭐⭐⭐ |

| Customer Satisfaction | ⭐⭐⭐⭐ |

✅ Verdict: ZippyLoan is an excellent solution for quick financial help, particularly if you value convenience over rigid bank requirements.

Frequently Asked Questions (FAQs)

❓ Is ZippyLoan legit?

Yes. ZippyLoan is a legitimate loan connection platform and a verified member of the Online Lenders Alliance (OLA).

❓ How fast can I get my money?

If approved before 5 PM CST, you can receive your funds as soon as the next business day.

❓ Does ZippyLoan check credit?

Submitting a loan request does not affect your credit score. A hard inquiry happens only after you choose and accept a lender’s offer.

❓ What is the maximum loan amount?

You can request between $100 and $15,000, depending on your income, credit, and lender approval.

❓ Is ZippyLoan safe to use?

Absolutely. The platform uses 256-bit SSL encryption to protect your personal and financial data.