Want to check your credit score for free in 2025?

📊 It’s easier than you think! Get started today and take control of your financial future.

🚀 Monitoring your credit is crucial for maintaining financial health, and we’re here to show you how!

🛠️ Whether you’re planning to buy a house or just staying on top of your finances, this guide will walk you through the simplest steps to access your credit score no cost involved!

Why Knowing Your Credit Score Really Matters

Think of your credit score as your financial reputation number. In the United States, it quietly influences your life in ways most people never notice whether you can rent an apartment, get a new credit card, buy a car, or secure a low-interest mortgage.

Even insurers and some employers check it to judge how responsibly you handle money.

Many Americans only look at their credit score after they’ve been denied a loan. By then, the damage is done.

The smarter approach is to monitor your credit proactively so you can fix errors early, track your progress, and strengthen your financial standing.

Let’s walk step-by-step through everything you need to know: what a credit score is, how it’s calculated, how to check it for free, and what to do if you find problems.

What Exactly Is a Credit Score?

A credit score is a three-digit number, typically between 300 and 850, that represents your creditworthiness how likely you are to repay borrowed money on time.

The higher your score, the less risky you appear to lenders.

| Score Range | Rating | What It Means |

|---|---|---|

| 800 – 850 | Excellent | Eligible for best rates & rewards |

| 740 – 799 | Very Good | Strong credit history |

| 670 – 739 | Good | Generally approved for credit |

| 580 – 669 | Fair | May face higher interest |

| 300 – 579 | Poor | Risky borrower; credit likely denied |

Two main scoring models exist in the U.S.:

- FICO Score – used by over 90 % of U.S. lenders.

- VantageScore – newer model used by many free credit sites.

Each uses slightly different formulas but both rely on data from your credit reports.

🔍 How to Check Your Credit Score for Free

You don’t have to pay for access to your credit score. Below are the best ways to check your credit score for free in the U.S.

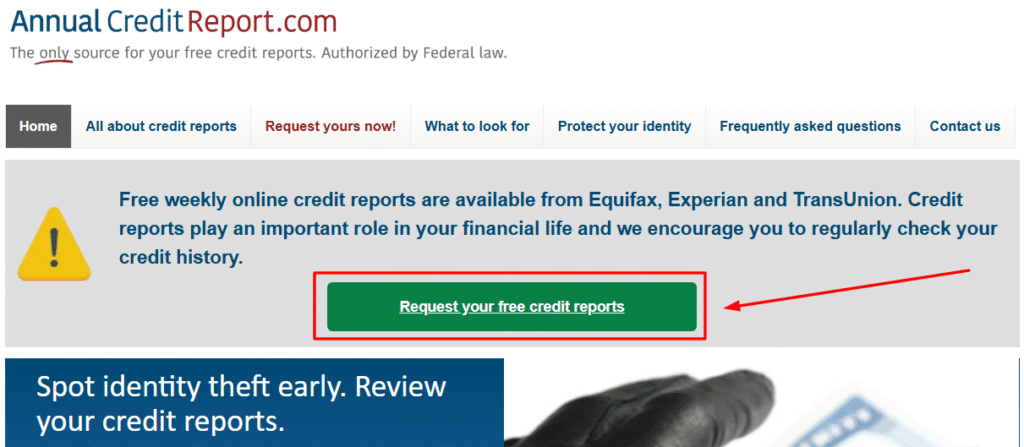

1️⃣ AnnualCreditReport.com – Official Government-Authorized Website

The only official site authorized by federal law to provide free access to your credit reports from all three bureaus.

- Cost: Free

- Frequency: Once per year from each bureau

- What you get: Full credit report, not the credit score

- Website: AnnualCreditReport.com

2️⃣ Free Credit Score from Credit Card Issuers

Many U.S. credit card companies provide free access to your FICO score or VantageScore.

- Discover Scorecard: Free access to your FICO score

- Capital One CreditWise: Free access to your VantageScore

- American Express MyCredit Guide: Free VantageScore

3️⃣ Free Credit Score Apps & Websites

Apps like Credit Karma and Credit Sesame give you free access to your VantageScore and update it regularly.

- Credit Karma: Free access to VantageScore from TransUnion and Equifax

- Credit Sesame: Free VantageScore from Experian

- Mint: Free VantageScore, with monthly updates

4️⃣ myFICO.com (Paid Option for Exact FICO Score)

If you need the official FICO score used by most lenders, you can purchase it from myFICO.com.

- Cost: Free and Starts at $29.95 per month

- What you get: Official FICO score from all three bureaus

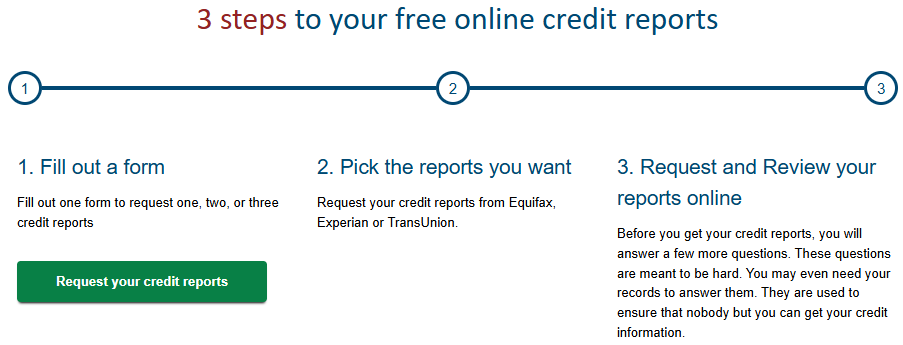

🧾 Steps Guide: Check Your Report on AnnualCreditReport.com

This process takes about 10 minutes and gives you instant online access to your credit report. Here’s how to do it:

Step 1: Go to the Official Website

Visit AnnualCreditReport.com official website.

Step 2: Request Your Free Credit Report

Click on “Request your free credit reports.”

Fill in your personal details name, address, Social Security number, and date of birth.

Step 3: Verify Your Identity

Answer questions related to past accounts or loans to verify your identity.

Step 4: View and Download Your Reports

Once your identity is verified, you can view your reports from Experian, Equifax, and TransUnion. Download or print the reports for your records.

💡 Pro Tip: Instead of checking all three reports at once, check one bureau every 4 months. You can effectively monitor your credit all year for free.

Free vs Paid Options for Checking Your Credit Score

Here’s a quick comparison of the best free vs paid options for checking your credit score:

| Source | Score Type | Frequency | Cost | Best For |

|---|---|---|---|---|

| AnnualCreditReport.com | Credit Report (no score) | Once a year (per bureau) | Free | Accuracy & Error Checking |

| Credit Karma / Sesame / Mint | VantageScore | Weekly/Monthly | Free | Ongoing Monitoring |

| myFICO.com | FICO | Monthly | Paid ($19.95 +) | Official FICO Score |

Tip: Use free options for regular monitoring and myFICO for official FICO scores when you’re planning to apply for a major loan.

The Three Credit Bureaus You Need to Know

Your credit score is based on the data reported to the three major credit bureaus in the U.S.:

- Experian

- Equifax

- TransUnion

Each bureau gathers information from lenders, banks, and other financial institutions regarding your payment history, loan balances, credit limits, and more.

Since not all creditors report to all three bureaus, your credit score may vary slightly between them.

Why Should You Check All Three?

To get the full picture of your credit history, it’s important to check all three bureaus. Sometimes, errors appear in one report that could affect your overall score.

What Factors Affect Your Credit Score?

Your credit score is influenced by several key factors. Here’s a breakdown:

1️⃣ Payment History (35%)

Your payment history is the most important factor. On-time payments improve your score, while late payments, bankruptcies, or collections can significantly lower it.

What to Do: Pay your bills on time to keep this factor strong.

2️⃣ Credit Utilization (30%)

Credit utilization is the percentage of your available credit that you’re using. The lower it is, the better it is for your score.

What to Do: Aim to keep your credit utilization below 30%.

3️⃣ Length of Credit History (15%)

A longer credit history demonstrates your ability to manage credit over time, which is better for your score.

What to Do: Keep older accounts open and maintain a long credit history.

4️⃣ New Credit Inquiries (10%)

Each time you apply for credit, a hard inquiry is made, which can lower your score temporarily. Too many inquiries in a short time can hurt your score.

What to Do: Limit applications for new credit.

5️⃣ Credit Mix (10%)

Having a mix of different types of credit (e.g., credit cards, loans) can positively affect your score.

What to Do: Maintain a balance of credit types, including both revolving and installment loans.

Quick Recap:

| Factor | Weight | Tips |

|---|---|---|

| Payment History | 35% | Pay on time, avoid late payments. |

| Credit Utilization | 30% | Keep usage below 30%. |

| Length of Credit History | 15% | Keep old accounts open. |

| New Credit Inquiries | 10% | Limit hard inquiries. |

| Credit Mix | 10% | Have a variety of credit accounts. |

How to Maintain a Healthy Credit Score

Achieving and maintaining a strong credit score requires time and dedication, but the sooner you start, the better. While the approach varies based on your individual credit situation, these key practices can help guide you toward success:

- Make Timely Payments:

The most significant factor in your credit score is your payment history. Always strive to pay your bills on time.

Payments are not reported as late until they are 30 days overdue, so if you miss a due date, catch up quickly to avoid a negative impact on your score.

- Keep Credit Card Balances Low:

A low credit utilization rate is crucial for a healthy score. Most people with excellent credit maintain utilization rates below 10%.

To achieve this, aim to pay off your credit cards in full each month and keep balances as low as possible at all times.

- Track Your Credit Score Regularly:

Regularly checking your credit score and reports allows you to monitor your progress and see how your actions impact your financial health. It also helps you identify any emerging issues early, giving you the chance to address them before they cause significant damage.

Credit Report vs Credit Score: What’s the Difference?

| Credit Report | Credit Score |

|---|---|

| A detailed record of your credit history. | A numerical representation of your creditworthiness. |

| Includes personal information (name, address, SSN), credit accounts, payment history, and inquiries. | A three-digit number that summarizes your credit history into a score (usually 300 to 850). |

| Shows a comprehensive overview of your financial behavior over time. | Provides a quick snapshot of your credit risk. |

| Helps lenders evaluate your credit behavior and payment history. | Helps lenders assess how likely you are to repay debt based on your history. |

| Can be over 30 pages long. | A single number (often 300-850). |

| Used for detailed credit analysis and detecting errors or fraud. | Used for quick decisions on credit approvals, loans, or interest rates. |

| No direct score shown in the report. | Directly determines if you qualify for credit or loans. |

✅ Conclusion

Checking your credit score regularly is a smart habit that keeps you in control of your financial future.

By utilizing free tools and methods like AnnualCreditReport.com, Credit Karma, and your credit card issuer’s app, you can track your credit health with ease. 🛠️

Remember, your credit score is an essential part of your financial life it impacts loan approvals, interest rates, and even job opportunities. By following the steps outlined in this guide, you’ll be better equipped to monitor, understand, and improve your credit score.

🏆 Start today, and stay proactive about your financial health! 🚀

Frequently Asked Questions (FAQs)

1. Can I check my credit score without paying?

Yes! You can check your credit score for free using services like Credit Karma, Credit Sesame, and through your credit card provider’s app. These platforms provide free access to your score regularly.

2. How often should I check my credit score?

Ideally, you should check your credit score at least once a year using AnnualCreditReport.com. However, if you’re monitoring changes or actively working to improve your score, checking it monthly through apps like Credit Karma is a great idea.

3. Does checking my credit score affect my credit?

No, checking your own credit score is considered a soft inquiry, which has no impact on your credit score. Hard inquiries only occur when you apply for new credit, which can slightly lower your score.

4. Is it necessary to check my credit score?

While it’s not strictly necessary, monitoring your credit score is crucial for catching any errors, spotting potential fraud, and ensuring that you are in good standing when applying for loans, credit cards, or even renting a home.

5. What if I find an error on my credit report?

If you notice any discrepancies or errors in your credit report, such as incorrect information about your accounts or payments, you should dispute them with the respective credit bureau. You are legally entitled to a free dispute process to fix inaccuracies.