If you’re struggling to keep up with credit card bills, medical expenses, or personal loans you’re not alone.

Millions of Americans face the same challenge every year. That’s where National Debt Relief (NDR) comes in one of the most trusted names in debt settlement.

But is it really effective? Can it actually reduce what you owe, or is it just another financial trap?

Let’s find out in this in-depth National Debt Relief Review 2025, where we’ll cover how it works, its real pros and cons, costs, and whether it’s legit.

🏛️ Overview of National Debt Relief (Expanded & SEO-Optimized)

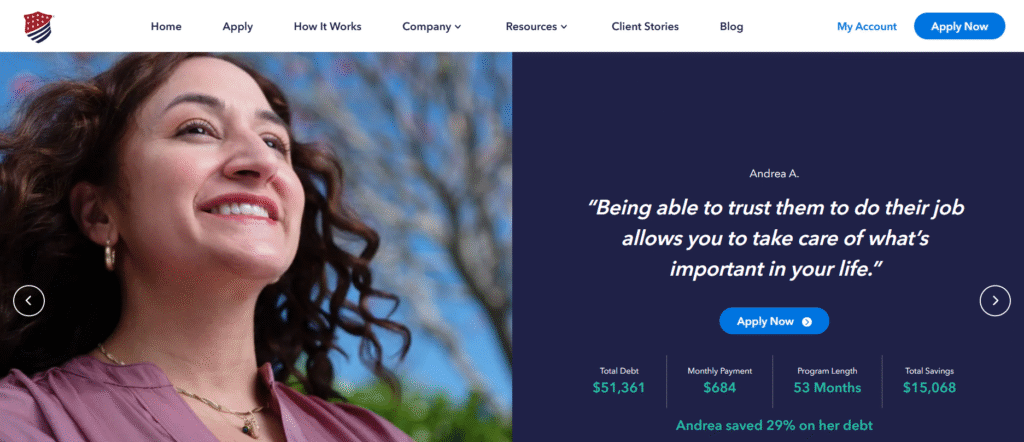

Founded in 2009, National Debt Relief (NDR) is one of America’s most established and trusted debt-settlement companies, with a mission to help everyday people break free from overwhelming unsecured debt without filing for bankruptcy.

Over the years, National Debt Relief has helped more than 500,000 clients successfully reduce their balances and rebuild financial stability.

The company operates nationwide, partnering with major credit card issuers and collection agencies to negotiate reduced payoff amounts on behalf of its clients.

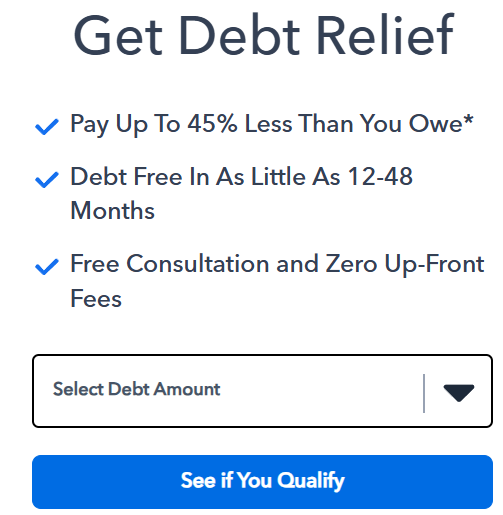

Unlike traditional lenders, NDR doesn’t offer loans or credit lines. Instead, it works as a professional negotiator between you and your creditors aiming to lower your total debt by up to 45% through structured settlement programs.

The company is accredited by the Better Business Bureau (A+ Rating) and the American Fair Credit Council (AFCC), ensuring compliance with strict ethical and transparency standards.

Its reputation for customer support and honest pricing has made it a popular choice among consumers looking for real financial relief.

📍 Key Facts

Headquarters: New York, USA

Founded: 2009

Accreditation: Better Business Bureau (A+), American Fair Credit Council

Clients Helped: 500,000+ nationwide

Average Savings: 30%–50% after fees

Average Program Length: 24–48 months

💬 In short: National Debt Relief isn’t a loan provider it’s a trusted mediator that helps you negotiate, settle, and close unsecured debts like credit cards, personal loans, or medical bills for less than you owe.

⚙️ How National Debt Relief Works (Verified 2025 Process)

National Debt Relief makes the debt-settlement process straightforward and stress-free you stay in control, while their debt experts handle the tough negotiations.

🧾 Step 1: Submit the Form for a Free Consultation

You start by filling out a short online form or calling their toll-free number. Within minutes, a certified debt consultant reaches out to discuss your financial situation at no cost and no obligation.

They’ll review your debts, monthly budget, and goals to see if you qualify for the program.

💡 Why it matters: This first call is completely free and helps you understand if debt settlement is even the right fit before committing.

💡 Step 2: They Build an Affordable Plan That Works for You

If you qualify, National Debt Relief creates a custom plan based on your income, living expenses, and debt amount.

Instead of paying multiple creditors each month, you’ll deposit a single, affordable monthly payment into a dedicated savings account that you fully control.

Once enough funds build up, their negotiators start reaching out to your creditors to settle each account usually for 30%–55% less than what you owe.

💬 Example:

If you owe $20,000, you might settle for $10,000–$13,000 depending on your creditors and negotiation success.

🕓 Step 3: Get Out of Debt Faster Than You Think

Clients typically complete their program in as little as 12 to 48 months, depending on how much they owe and how much they can deposit monthly.

Once settlements are complete, NDR pays each creditor from your savings account, and you walk away debt-free often saving up to 45% overall.

💬 Average timeline: 2–4 years for full debt resolution.

💬 Average savings: 30–50% after fees.

Check If You Qualify: Free & No Credit Impact

💳 Debt Types National Debt Relief Can Help With

National Debt Relief focuses on unsecured debts those not backed by collateral like a home or car.

If you’re overwhelmed by credit cards, personal loans, or medical bills, here’s where they can truly help 👇

1. Repossessions:

Can settle leftover deficiency balances after a repossessed asset is sold.

2. Credit Card Debt:

Negotiates directly with credit card companies to reduce balances by up to 45%, helping you escape endless interest cycles.

3. Personal Loans:

Settles unsecured loans from banks or online lenders for less than you owe.

4. Medical Bills:

Works with hospitals and collectors to lower large medical balances.

5. Lines of Credit:

Helps reduce what you owe on unsecured personal or business credit lines.

6. Collections & Charge-Offs:

Even if accounts are in collections, NDR can negotiate final settlements to close them.

7. Business Debts:

Assists small business owners with unsecured loans or credit lines.

8. Private Student Loans (Some):

Certain private loans in default may qualify for negotiation.

⚠️ Debts Not Eligible

National Debt Relief cannot help with:

❌ Mortgages or car loans (secured debts)

❌ Federal student loans

❌ Child support or alimony

❌ Taxes or utility bills

💬 In short: If your debt isn’t tied to property or government payments, there’s a strong chance NDR can help reduce it.

💰 How Much Does National Debt Relief Cost?

When it comes to fees, National Debt Relief follows a performance-based model meaning you pay only after they negotiate a settlement for you.

✔ Key Fee Details

- No up-front fees. You won’t be charged until three things happen: a settlement offer is made, you approve it, and at least one payment is made.

- Typical fee range: ≈ 15% to 25% of the total enrolled debt.

- Some sources cite a slightly wider range (~18%-25%) depending on state laws and debt types.

- Example: If you enroll $20,000 in debt, you might pay $3,000 to $5,000 in fees over the life of the program.

🧮 What This Means for You

- The larger your enrolled debt, the more substantial the potential fees but also potentially greater savings.

- Because you stop direct payments to creditors and deposit into a settlement fund instead, you should be prepared for program duration of 24-48 months in many cases.

- While you pay a percentage, you may still come out ahead if your debt is significantly reduced (interest and fees stop accruing).

- Important: Charges for forgiven debt (tax implications) and impacts on credit score are not included in the fee they’re extra costs to consider.

✅ Quick Snapshot

| Item | Typical Value |

|---|---|

| Up-front fee | $0 (none) |

| Fee percentage | 15%–25% of debt enrolled |

| Fees owed when | After your first settlement payment is made |

| Program length | ~24–48 months (varies by case) |

✅ Pros and ❌ Cons of National Debt Relief

Before joining any debt-settlement program, it’s smart to weigh both sides.

Here’s what makes National Debt Relief (NDR) stand out and what you should keep in mind before signing up 👇

No upfront fees

You only pay after at least one debt is settled

Accredited & trusted

A+ BBB rating, AFCC member

Average savings of 30%–50% after fees

Free consultation to check eligibility

Professional negotiators handle all creditor communication

Transparent pricing and no hidden costs

Helps avoid bankruptcy and gives a clear payoff path

Credit score impact

Your score may drop during the program

Takes time

Most programs last 24–48 months

Not all debts qualify

Secured loans, taxes, or federal student loans excluded

Possible creditor contact or lawsuits before settlements

Forgiven debt may be taxable

Discipline required

Missed deposits can delay settlements

Availability varies by state

💬 In short: National Debt Relief offers a realistic path to becoming debt-free but it requires patience, consistency, and a temporary hit to your credit while you rebuild.

🧩 Is National Debt Relief Legit?

Yes National Debt Relief is 100% legitimate and one of the most established debt-settlement companies in the U.S.

They’ve been operating since 2009, are accredited by the Better Business Bureau (A+ rating), and are members of the American Fair Credit Council (AFCC) — an organization that enforces strict ethical standards for debt-relief companies.

💬 Customer Ratings:

- ⭐ 4.7/5 on Trustpilot (40,000+ reviews)

- ⭐ 4.9/5 on ConsumerAffairs

- ⭐ 4.6/5 on Google Reviews

Clients consistently praise NDR for transparency, friendly consultants, and successful settlements. While some report credit dips during the program (which is normal for debt settlement), most say it was worth the trade-off for becoming debt-free.

✅ Bottom line: National Debt Relief is not a scam it’s a regulated, trusted, and results-driven company that has helped hundreds of thousands of Americans regain control of their finances.

Check If You Qualify: Free & No Credit Impact

How to Qualify for National Debt Relief

You might qualify for the National Debt Relief program if you meet a few basic conditions 👇

- You owe at least $7,500–$10,000 in unsecured debt (like credit cards, personal loans, or medical bills).

- You’re struggling to make monthly payments or experiencing financial hardship.

- You can make regular deposits into your dedicated savings account to fund settlements. 🧍♀️

- You live in a state where NDR operates (availability varies).

💡 Tip: Even if you’re unsure, the free consultation can confirm eligibility it doesn’t affect your credit and gives you clarity on your options.

🔄 Alternatives to National Debt Relief

Debt settlement isn’t the only way to get relief.

Here are some alternatives worth comparing:

1️⃣ Debt Consolidation Loan:

Combine all debts into one monthly payment with a lower interest rate good for people with decent credit.

2️⃣ Credit Counseling:

Nonprofit agencies can lower interest rates and create structured payoff plans without affecting credit as much.

3️⃣ Balance Transfer Card:

Transfer high-interest credit balances to a card with 0% APR for 12–18 months to pay them off faster.

4️⃣ DIY Negotiation:

Call creditors directly to request lower balances or payment plans best if you’re comfortable handling it yourself.

5️⃣ Bankruptcy (Last Resort):

Discharges most debts but damages credit for 7–10 years. Consider only when no other option works.

💬 In short: National Debt Relief is ideal if your debt is too large for consolidation but not extreme enough for bankruptcy.

⚖️ How Does National Debt Relief Compare?

| Company | Avg Savings | Fees | BBB Rating | Program Length | Upfront Fees |

|---|---|---|---|---|---|

| National Debt Relief | 30–50% | 15–25% | A+ | 24–48 mo | ❌ None |

| Freedom Debt Relief | 25–45% | 15–25% | A | 24–60 mo | ❌ None |

| Accredited Debt Relief | 20–40% | 15–25% | A+ | 24–48 mo | ❌ None |

| CuraDebt | 30–50% | 15–25% | A+ | 24–48 mo | ❌ None |

🏆 Best For: People who value transparency, no hidden fees, and consistent customer support.

💬 Verdict: National Debt Relief leads the pack in reliability and verified customer satisfaction.

⚠️ Know the Risks of Debt Settlement

Debt settlement offers big savings, but it’s not risk-free. Here’s what to expect 👇

📉 1. Credit Score Drop: Your credit may temporarily decline as payments stop to creditors.

⏳ 2. Takes Time: Most programs last 2–4 years.

💵 3. Tax Implications: Forgiven debt can be considered taxable income.

⚖️ 4. Creditor Action: Some creditors may still attempt lawsuits before settlements.

💬 5. Discipline Needed: Missed deposits or delays can slow your progress.

🧠 Reality check: Debt settlement isn’t an instant fix but it’s a practical, legal path out of overwhelming debt for people willing to stay consistent.

Check If You Qualify: Free & No Credit Impact

🏁 Should You Choose National Debt Relief?

If you’re burdened by high-interest credit card debt or medical bills and want to avoid bankruptcy, National Debt Relief can be a genuine lifeline.

✅ Choose NDR if:

- You owe $10,000+ in unsecured debt

- You’re facing constant creditor pressure

- You’re ready to commit to a structured program

❌ Skip it if:

- Your debt is below $7,000

- You can still afford your minimum payments

- You want a faster credit-recovery method

💬 Final word: National Debt Relief won’t erase your debt overnight but it can help you become debt-free within a few years while saving thousands in the process.

“RELATED ARTICLES”

Frequently Asked Questions

1. How long does the National Debt Relief program take?

Most clients finish within 24–48 months, depending on total debt and monthly contributions.

2. Does National Debt Relief affect credit scores?

Yes, temporarily since you stop paying creditors directly. Most clients rebuild credit after completing the program.

3. Can I cancel my National Debt Relief plan?

Yes. You can cancel anytime without penalty, though unsettled debts will remain your responsibility.

4. Is National Debt Relief available in all states?

Not all check availability on their official website before applying.

5. What types of debt qualify?

Unsecured debts like credit cards, medical bills, and personal loans. Secured debts (like mortgages or auto loans) are not eligible.