Financial emergencies don’t knock before arriving sometimes you just need quick access to cash. Whether it’s an unexpected bill, home repair, or medical emergency, waiting weeks for bank approval can be stressful.

That’s where VivaLoan steps in. It’s a modern loan connection service that bridges the gap between borrowers and trusted lenders in minutes.

With loans ranging from $100 to $15,000, VivaLoan claims to make personal borrowing fast, simple, and secure.

In this in-depth review, we’ll explore how VivaLoan works, its benefits, eligibility criteria, safety features, and whether it’s truly worth your trust in 2025.

What Is VivaLoan?

VivaLoan is not a direct lender. Instead, it’s a loan-matching platform designed to connect borrowers with a network of verified lenders. 💡

By completing a short online form, users are matched to potential lenders based on their credit profile, income, and requested loan amount. If approved, you can e-sign your loan agreement instantly and get funds deposited into your account sometimes as soon as the next business day.

Key Highlights:

- Accreditation: OLA (Online Lenders Alliance) compliant

- Loan Range: $100 to $15,000

- Application Time: 5 minutes

- Funding Time: Next business day

- Eligibility: U.S. residents, 18+ years, steady income

- Encryption: 256-bit SSL security

How VivaLoan Works (Step-by-Step Process)

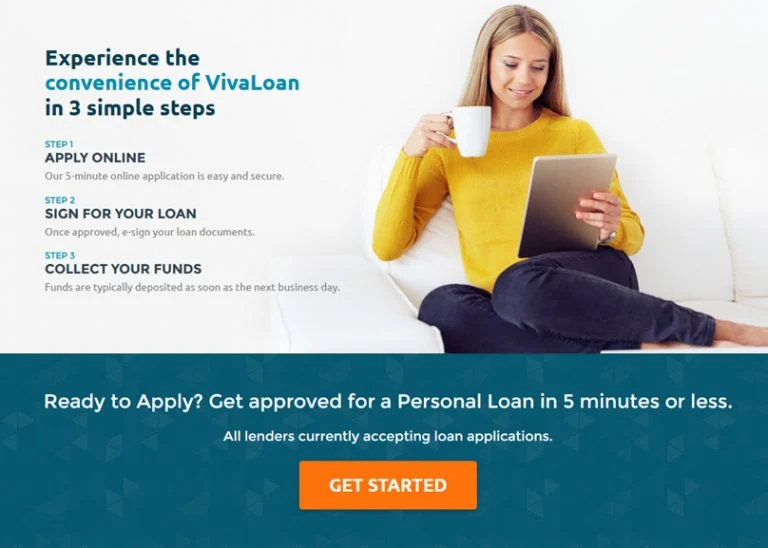

⚙️ One of the biggest advantages of VivaLoan is simplicity. The platform makes borrowing as easy as three quick steps:

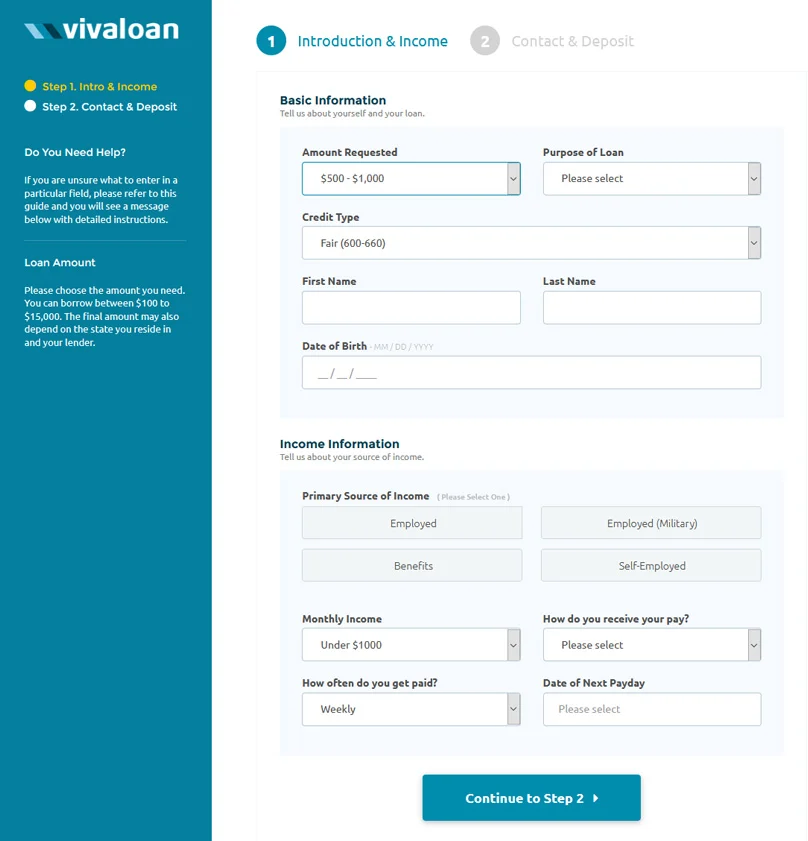

Step 1: Fill Out the Online Form (Takes Under 5 Minutes)

Start by visiting the official VivaLoan website and filling out a short application form. You’ll need to provide:

- Proof of identity

- Employment or income details

- Bank account information

The platform’s mobile-optimized design allows users to apply easily from phones or tablets.

✅ Tip: Make sure the income details you provide match your recent pay statements to avoid delays.

Step 2: Get Matched and Review Your Offer

Once the form is submitted, VivaLoan runs your details through its network of lenders. Within seconds, you’ll see offers tailored to your profile.

Each lender provides details about:

- Loan amount and repayment terms

- Annual Percentage Rate (APR)

- Total repayment amount and due dates

You can then review and e-sign your preferred offer instantly no faxes, no physical paperwork, and no office visits.

Step 3: Receive Your Funds Quickly

After signing the agreement, funds are usually deposited directly into your checking account within 24 hours.

This fast turnaround makes VivaLoan ideal for emergencies like:

- Medical bills

- Utility or rent payments

- Car repairs

- Family or travel emergencies

✅ Remember: The faster you verify your identity and sign, the quicker your lender can release funds.

💳 Loan Repayment Process

Repayments are made directly from the same bank account where funds were deposited. Many lenders in VivaLoan’s network allow flexible terms including installment plans up to 60 months, or shorter payday-style loans for smaller amounts.

🔍 Key Features That Make VivaLoan Stand Out

Let’s dive into the core features that define VivaLoan these are the most important for SEO ranking and user clarity.

1. Fast Funding: Get Money As Soon As Tomorrow

When emergencies strike, time matters. VivaLoan’s network specializes in speed once connected to a lender and approved, money is often deposited by the next business day. 🕒

This makes it an ideal option for:

- Medical emergencies

- Urgent car repairs

- Last-minute travel

- Overdue utility bills

✅ Speed is VivaLoan’s strongest selling point.

2. All Credit Types Accepted

Unlike traditional banks, VivaLoan doesn’t reject applicants for having poor or limited credit. Whether your score is excellent, fair, or bad, the platform’s wide network increases your chances of approval. 💳

Borrowers with steady income and a valid checking account can still get connected to suitable lenders.

This inclusivity makes VivaLoan particularly popular among those rebuilding their financial profile.

3. You’re in Control

⚙️ VivaLoan lets borrowers choose flexible repayment options. Depending on your lender, you can:

- Repay in monthly installments (for larger loans)

- Repay on your next payday (for short-term loans)

This adaptability allows you to choose what best fits your situation a rare level of control in online lending.

4. Rebuild Your Credit

Here’s something many users overlook:

Several lenders in the VivaLoan network report on-time payments to major credit bureaus. 📈

That means using VivaLoan responsibly can actually help improve your credit score over time giving it a long-term financial advantage.

5. Safe and Secure Borrowing

Your data security is a top priority. VivaLoan employs 256-bit SSL encryption, which is the same standard used by leading financial institutions. 🔐

This ensures all personal and financial information you share is protected during every transaction.

6. OLA Compliance: A Sign of Trust

VivaLoan is a proud member of the Online Lenders Alliance (OLA) an organization dedicated to ethical lending and consumer protection.

This compliance means VivaLoan operates under strict conduct guidelines, transparency standards, and fair borrowing practices minimizing risks of predatory lending or hidden fees. 🛡️

🧾 How You Can Use a VivaLoan Personal Loan

VivaLoan gives borrowers the freedom to use funds however they need. Let’s understand the most common ways real users utilize these loans:

| Purpose | Why It Matters |

|---|---|

| 💳 Debt Consolidation | Combine multiple high-interest credit cards or payday loans into one single monthly payment. You save on interest and simplify repayment. |

| 🏠 Home Improvement | Renovate, repair, or upgrade your home without tapping into your savings. Small upgrades can even increase property value. |

| 🚗 Major Purchases | Finance large items like furniture, electronics, or auto repairs instead of maxing out credit cards. |

| 💉 Medical Emergencies | Handle unplanned healthcare expenses or hospital stays without delay. |

| 🎓 Education or Training | Cover tuition or short courses that can boost your job prospects. |

| 🚑 Unexpected Expenses | From vet bills to appliance breakdowns these loans fill the gap when life throws surprises. |

| ✈️ Travel or Vacations | Plan a trip and pay it back in manageable installments. |

💡 The best part lenders don’t ask you to justify the purpose, as long as your use is legal.

Eligibility & Requirements

To qualify for a VivaLoan-matched lender, you’ll need to meet a few basic criteria:

1. Be at least 18 years old – required by U.S. law.

2. Have a regular source of income – job, self-employment, or benefits.

3. Hold an active checking account – for deposit and automatic repayment.

4. Provide valid identification – driver’s license or government ID.

5. Be a U.S. citizen or permanent resident.

While these conditions are standard, approval depends on your lender each has its own underwriting criteria.

✅ Tip: Make sure your income-to-debt ratio is healthy (below 40%) for better approval odds.

🔐 Safety & Security: Is VivaLoan Legit?

Yes, VivaLoan is 100% legitimate. It’s a licensed, OLA-compliant platform that protects users through transparency and encryption.

Here’s how VivaLoan ensures safety:

1️⃣ 256-Bit SSL Encryption

Every form you fill or document you sign is protected with bank-grade SSL encryption, preventing third-party access to your data.

2️⃣ Online Lenders Alliance (OLA) Membership

VivaLoan is a verified member of the Online Lenders Alliance, which means:

- It operates under strict U.S. lending standards

- It promotes fair, transparent loan terms

- It avoids predatory or illegal lending behavior

3️⃣ Transparent Lending Terms

VivaLoan doesn’t charge application fees. The platform simply connects you to lenders. You’ll only owe money to the lender who issues your loan.

4️⃣ Data Privacy

Your personal data is used only for loan matching and communication never sold to third parties.

✅ In short, VivaLoan’s compliance, encryption, and ethical approach make it one of the safest online loan facilitators.

🧮 Repayment Flexibility

Every borrower’s situation is unique, and VivaLoan’s strength lies in offering multiple repayment paths through its lender network:

1. Installment Loans (Up to 60 Months)

Ideal for larger amounts ($2,000–$15,000). Fixed monthly payments spread the burden evenly, making budgeting easier.

2. Short-Term or Payday Loans

Perfect for smaller emergencies ($100–$500). These are repaid in full on your next payday.

3. Early Repayment Option

Many lenders let you pay off early without penalties, saving on interest.

4. Automatic Payment Scheduling

Payments are auto-debited from your account, reducing the chance of missing due dates which also protects your credit score.

📈 VivaLoan vs. Competitors

| Feature | VivaLoan | ZippyLoan | CashUSA |

|---|---|---|---|

| Loan Range | $100 – $15,000 | $100 – $15,000 | $500 – $10,000 |

| Approval Time | Minutes | Minutes | Same Day |

| Funding Time | 1 Business Day | 1 Business Day | 1–2 Days |

| Credit Types Accepted | All | All | All |

| Max Term | 60 Months | 60 Months | 72 Months |

| OLA Member | ✅ Yes | ✅ Yes | ✅ Yes |

| Direct Lender | ❌ No | ❌ No | ❌ No |

| Security Level | 256-bit SSL | 256-bit SSL | 256-bit SSL |

| Mobile-Friendly | ✅ Fully Optimized | ✅ | ✅ |

✅ While all three are credible, VivaLoan stands out for its clean interface, faster matching system, and transparent explanation of how funds are handled.

VivaLoan Pros & Cons

✅ Pros

- Quick and simple process: You can finish the form in under 5 minutes.

- Wide lender network: Improves approval odds even with bad credit.

- Fast funding: Get money within 24 hours after approval.

- No hidden fees: Free to use; the platform earns through lenders.

- Security: Bank-level SSL encryption and OLA standards.

- Flexible terms: Choose short-term or long-term repayment plans.

- Credit-building potential: Responsible repayment can boost your score.

❌ Cons

- Not a direct lender: VivaLoan can’t guarantee rates or approvals.

- APR varies: Each lender sets their own interest rate.

- U.S. only: The service isn’t available internationally.

- Limited control: Borrowers can’t choose their lender manually.

✅ Verdict: The pros strongly outweigh the cons if you value speed, security, and simplicity.

User Experience & Interface

A. Streamlined Application Process

VivaLoan’s application process is designed for efficiency and user-friendliness. The online form is concise, typically taking under 5 minutes to complete. This simplicity is particularly beneficial for users who may be new to online lending platforms or those seeking a quick solution to their financial needs.

B. Mobile Optimization

Recognizing the importance of accessibility, VivaLoan has optimized its platform for mobile devices. This ensures that users can apply for loans, review offers, and manage their accounts seamlessly from smartphones and tablets, catering to the on-the-go lifestyle of many borrowers.

C. Transparency and Information Accessibility

VivaLoan provides clear information about the loan process, including eligibility criteria, loan amounts, and repayment options. This transparency helps users make informed decisions and reduces the uncertainty often associated with online lending.

D. Security Measures

The platform employs robust security protocols, including 256-bit SSL encryption, to protect users’ personal and financial information. This commitment to security fosters trust and confidence among borrowers.

E. Customer Support

While VivaLoan offers a user-friendly interface, some users have reported challenges with customer support responsiveness. It’s essential for potential borrowers to be aware of this aspect and consider it when deciding to engage with the platform.

Is VivaLoan Worth It in 2025?

In 2025’s fast-paced financial world, VivaLoan is undeniably one of the best platforms for quick, secure, and flexible borrowing. It excels in speed, accessibility, and security, making it an excellent choice for individuals who need small to medium loans quickly and safely.

The platform is ideal for:

- Borrowers who need emergency funds or funds for smaller financial needs.

- People with less-than-perfect credit who may struggle with traditional lenders.

- Anyone seeking a transparent, secure loan process, with no hidden fees.

However, if you are seeking a larger loan or live outside the U.S., you may want to explore other alternatives that can meet those needs.

Given its user-friendly interface, transparency, and fast approval process, VivaLoan has emerged as a trustworthy platform for online lending in 2025.

So, in summary, VivaLoan is a great choice if you need a quick loan with flexible terms and a secure process especially if you have credit challenges. However, always make sure to carefully review loan terms and consider your ability to repay. For those who meet the criteria, it’s a highly dependable platform worth using.

⭐ Our Rating: 4.8/5

- Highly recommended for anyone in need of fast, secure, and flexible borrowing options.

Frequently Asked Questions

1️⃣ Is VivaLoan a direct lender?

No. VivaLoan connects you to third-party lenders who issue and manage the actual loan.

2️⃣ Does VivaLoan charge fees?

No. The service is completely free. You only pay interest and fees charged by your lender.

3️⃣ How fast can I get the money?

Most users receive funds within one business day after e-signing their loan agreement.

4️⃣ What’s the minimum credit score required?

There’s no fixed credit score requirement all credit types are considered.

5️⃣ Will applying affect my credit score?

Submitting your request does not affect your score. However, if you proceed with a loan, the lender may run a soft or hard inquiry.